Wealthy Manufacturing Company purchased 40 percent of the voting shares of Diversified Products Corporation on March 23,

Question:

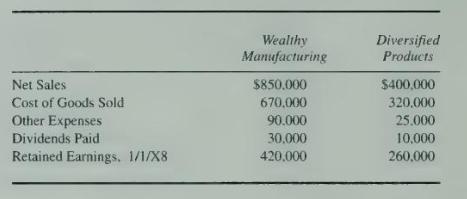

Wealthy Manufacturing Company purchased 40 percent of the voting shares of Diversified Products Corporation on March 23, 20X4. On December 31, 20X8, the controller of Wealthy Manufacturing Company attempted to prepare income statements and retained earnings statements for the two companies using the following summarized 20X8 data:

Wealthy Manufacturing Company uses the equity method in accounting for its investment in Diversified Products. The controller was also aware of the following specific transactions for Diversified Products in 20X8, which were not included in the preceding data:

1. On June \(30,20 X 8\), Diversified paid \(\$ 98,500\) to repurchase and retire bonds with a book value of \(\$ 103.500\).

2. Diversified sold its entire Health Technologies division on September 30, 20X8, for \(\$ 375,000\). The book value of Health Technologies division's net assets on that date was \(\$ 331,000\). The division incurred an operating loss of \(\$ 15,000\) in the first nine months of \(20 \mathrm{X} 8\).

3. On January 1, 20X8, Diversified switched from FIFO inventory costing to the weighted-average method. Had Diversified always used the weighted-average method, prior years' income would have been lower by \(\$ 20,000\).

4. During 20X8, Diversified sold one of its delivery trucks after it was involved in an accident and recorded a gain of \(\$ 10,000\).

\section*{Required}

a. Prepare an income statement and retained earnings statement for Diversified Products Corporation for 20X8.

b. Prepare an income statement and retained earnings statement for Wealthy Manufacturing Company for 20X8.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King