Wick plc has produced the following trial balance as at 31 August 2002 as a basis for

Question:

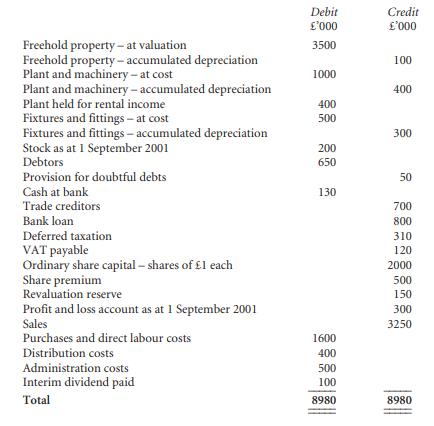

Wick plc has produced the following trial balance as at 31 August 2002 as a basis for the preparation of its published accounts:

Additional information (1) As a new venture, the company started work on a long-term contract in October 2001 and the above trial balance includes transactions relating to this contract which was in progress as at 31 August 2002. The agreed total contract price is £600 000 and there was work certified of £250 000, included in Sales, as at 31 August 2002. Costs to 31 August 2002 amounted to £400 000, included in Purchases, with estimated costs to completion of £300000. Progress payments received by 31 August 2002 amounted to £340000; these have been debited to Cash at bank and credited to Debtors.

(2) Stock at 31 August 2002 was valued at £300 000 and comprised finished goods of £50 000 and goods awaiting completion of £250 000. These amounts exclude the longterm contract.

(3) Depreciation has yet to be provided for as follows:

● Freehold property – 2.5% p.a. on valuation. The land element is £1.5 million.

● Plant and machinery – 10% p.a. on cost.

● Plant held for rental is for short-term hire and was acquired in the year ended 31 August 2002 – 20% p.a. on cost.

● Fixtures and fittings – 20% p.a. on cost.

It is company policy to provide a full year’s depreciation charge in the year of acquisition.

(4) The bank loan was taken out on 1 September 2000 and is repayable in five equal annual instalments starting from 1 September 2001. Interest is charged at 7% p.a. on the balance owing on 1 September each year and has not yet been paid for the current year.

(5) The company is proposing a final dividend of 10p per share.

(6) Corporation tax of 30% of pre-tax profit is to be provided for, including an increase in the deferred taxation provision of £100000.

Requirements

(a) Prepare the profit and loss account for the year ended 31 August 2002 and a balance sheet as at that date for Wick plc in a form suitable for publication, providing the disclosure note for Stock. (20 marks)

NOTE: You are not required to prepare any other disclosure notes.

(b) Identify and explain two areas in accounting for long-term contracts where judgement has to be exercised. (5 marks)

ICAEW, Financial Reporting, September 2002 (25 marks)

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780073526744

7th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey