Winter Corporation owns 80 percent of the stock of Ray Guard Corporation and 90 percent of the

Question:

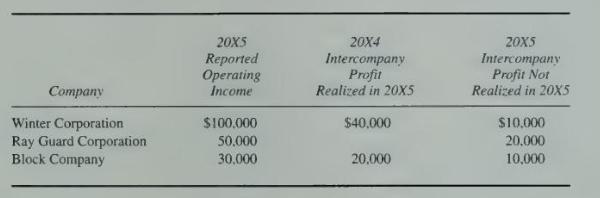

Winter Corporation owns 80 percent of the stock of Ray Guard Corporation and 90 percent of the stock of Block Company. The companies file a consolidated tax return each year and in 20X5 paid a total tax of \(\$ 80,000\). Each of the companies is involved in a number of intercompany inventory transfers each period. Information on the activities of the companies for 20X5 is as follows:

\section*{Required}

a. Determine the amount of income tax expense that should be assigned to each company.

b. Compute consolidated net income for 20X5.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King

Question Posted: