You are the management accountant of Short plc. On 1 October 1993 Short plc issued 10 million

Question:

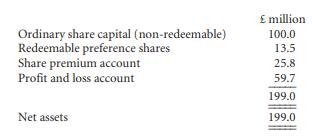

You are the management accountant of Short plc. On 1 October 1993 Short plc issued 10 million £1 preference shares at par, incurring issue costs of £100 000. The dividend payable on the preference shares was a fixed 4% per annum, payable on 30 September each year in arrears. The preference shares were redeemed on 1 October 1998 at a price of £1.35 per share. The effective finance cost of the preference shares was 10%. The balance sheet of the company on 30 September 1998, the day before the redemption of the preference shares, was as follows:

Requirements

(a) Write a memorandum to your assistant which explains:

● how the total finance cost of the preference shares should be allocated to the profit and loss account over their period of issue;

● where in the profit and loss account the finance cost should be reported;

● where the preference shares should be disclosed in the balance sheet;

● the nature of any supporting information which is required to be disclosed in the notes to the financial statements regarding the preference shares.

Your memorandum should refer to the provisions of relevant Accounting Standards.

(8 marks)

(b) Calculate the finance cost in respect of the preference shares for EACH of the five years ended 30 September 1998. (7 marks)

(c) Assuming no changes other than those caused by the redemption of the preference shares, prepare the balance sheet of Short plc at the end of 1 October 1998. You should give an explanation for any changes to any of the headings or any new headings which are required. (5 marks)

CIMA, Financial Reporting, November 1998 (20 marks)

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780073526744

7th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey