Problem 15, part f in Chapter 3 asks you to construct a five-year financial projection for Aquatic

Question:

Problem 15, part f in Chapter 3 asks you to construct a five-year financial projection for Aquatic Supplies beginning in 2018. Based on your forecast or the suggested answer available through McGraw-Hill’s Connect, answer the following questions.

| AQUATIC SUPPLIES CO. | ||||||

| INCOME STATEMENT ($ millions) | ||||||

| Actual | Forecast | |||||

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Sales | 582.762 | 652.693 | 731.017 | 818.739 | 916.987 | 1,027.026 |

| Cost of Goods Sold | 240.828 | 254.550 | 285.096 | 319.308 | 357.625 | 400.540 |

| Gross Profit | 341.934 | 398.143 | 445.920 | 499.431 | 559.362 | 626.486 |

| Selling, General, & Administrative Exp. | 257.507 | 319.820 | 358.198 | 401.182 | 449.324 | 503.243 |

| Operating Income Before Deprec. | 84.427 | 78.323 | 87.722 | 98.249 | 110.038 | 123.243 |

| Depreciation & Amortization | 25.221 | 29.371 | 32.896 | 36.843 | 41.264 | 46.216 |

| Operating Profit | 59.206 | 48.952 | 54.826 | 61.405 | 68.774 | 77.027 |

| Interest Expense | 16.430 | 18.636 | 18.801 | 18.841 | 18.733 | 18.446 |

| Pretax Income | 42.776 | 30.316 | 36.025 | 42.564 | 50.041 | 58.581 |

| Total Income Taxes | 14.971 | 10.611 | 12.609 | 14.897 | 17.514 | 20.503 |

| Net Income | 27.805 | 19.705 | 23.416 | 27.667 | 32.527 | 38.078 |

| BALANCE SHEET ($ millions) | ||||||

| ASSETS | ||||||

| Cash & Equivalents | 7.152 | 13.054 | 14.620 | 16.375 | 18.340 | 20.541 |

| Account Receivable | 70.538 | 84.850 | 95.032 | 106.436 | 119.208 | 133.513 |

| Inventories | 39.033 | 32.635 | 36.551 | 40.937 | 45.849 | 51.351 |

| Prepaid Expenses | 9.339 | 9.339 | 9.339 | 9.339 | 9.339 | 9.339 |

| Other Current Assets | 27.076 | 39.162 | 43.861 | 49.124 | 55.019 | 61.622 |

| Total Current Assets | 153.138 | 179.039 | 199.403 | 222.211 | 247.756 | 276.366 |

| Net Property, Plant, & Equipment | 81.648 | 97.904 | 109.652 | 122.811 | 137.548 | 154.054 |

| Intangible Assets | 9.415 | 9.415 | 9.415 | 9.415 | 9.415 | 9.415 |

| Other Assets | 24.642 | 32.635 | 36.551 | 40.937 | 45.849 | 51.351 |

| TOTAL ASSETS | 268.843 | 318.993 | 355.022 | 395.374 | 440.568 | 491.186 |

| LIABILITIES | ||||||

| Accounts Payable | 36.951 | 39.162 | 43.861 | 49.124 | 55.019 | 61.622 |

| Accrued Expenses | 31.206 | 32.635 | 36.551 | 40.937 | 45.849 | 51.351 |

| Other Current Liabilities | 3.663 | 3.663 | 3.663 | 3.663 | 3.663 | 3.663 |

| Total Current Liabilities | 71.820 | 75.459 | 84.075 | 93.724 | 104.532 | 116.636 |

| Long Term Debt | 157.720 | 186.363 | 188.010 | 188.414 | 187.327 | 184.462 |

| Accrued Wages | 21.418 | 19.581 | 21.930 | 24.562 | 27.510 | 30.811 |

| Total Liabilities | 250.958 | 281.403 | 294.015 | 306.701 | 319.368 | 331.908 |

| EQUITY | ||||||

| Common Stock | 1.702 | 1.702 | 1.702 | 1.702 | 1.702 | 1.702 |

| Capital Surplus | 55.513 | 55.513 | 55.513 | 55.513 | 55.513 | 55.513 |

| Retained Earnings | 118.729 | 138.434 | 161.851 | 189.517 | 222.044 | 260.122 |

| Less: Treasury Stock | 158.059 | 158.059 | 158.059 | 158.059 | 158.059 | 158.059 |

| Total Equity | 17.885 | 37.590 | 61.007 | 88.673 | 121.200 | 159.278 |

| TOTAL LIABILITIES & EQUITY | 268.843 | 318.993 | 355.022 | 395.374 | 440.568 | 491.186 |

a. Calculate the company’s times-interest-earned ratio for each year from 2017 to 2022.

b. Calculate the percentage EBIT can fall before interest coverage dips below 1.0 for each year from 2017 to 2022.

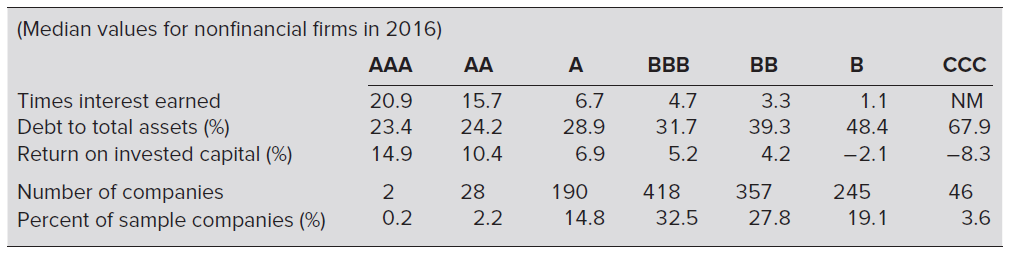

c. Consulting Table 6.5 in the text, what bond rating would Aquatic Supplies have in 2017 if the rating was based solely on the firm’s interest coverage ratio?

d. Based on this rating, would a significant increase in financial leverage be a prudent strategy for Aquatic Supplies?

Data from Prob. 15 (f), Chapter 3

Return the dividend payout ratio to 40%. Now suppose Ottawa wants to make up any financing shortfall with increased debt. How high would the debt/equity ratio have to be to make up the difference?

Table 6.5

An intangible asset is a resource controlled by an entity without physical substance. Unlike other assets, an intangible asset has no physical existence and you cannot touch it.Types of Intangible Assets and ExamplesSome examples are patented... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer: