Refer to Exhibit 2.8. The Sarbanes-Oxley Act enacted which of the following provisions relevant to auditors and

Question:

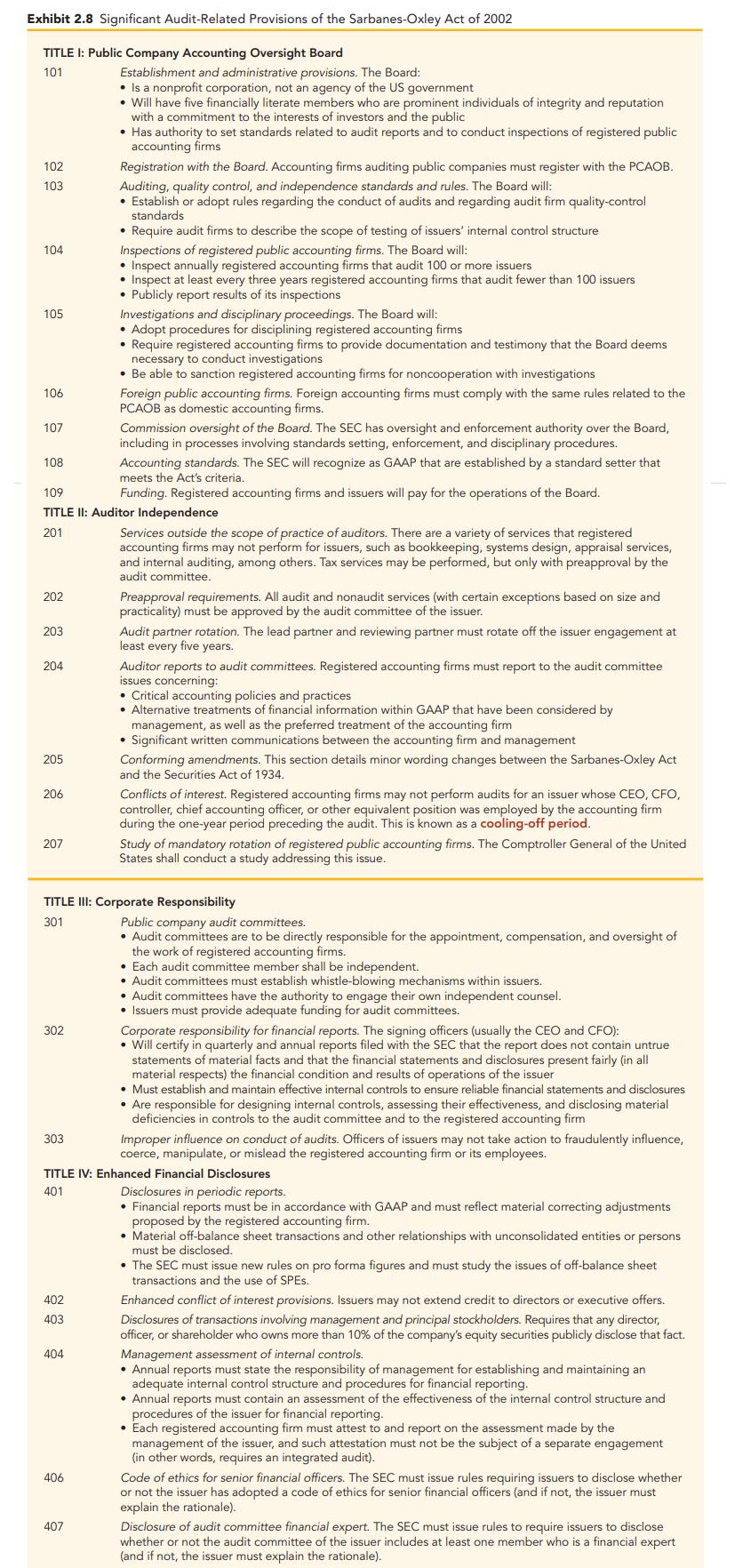

Refer to Exhibit 2.8. The Sarbanes-Oxley Act enacted which of the following provisions relevant to auditors and the audit opinion formulation process?

a. The PCAOB was established, and it has the power to conduct inspections of public company audits.

b. The lead audit partner and reviewing partner must rotate off the audit of a publicly traded company at least every ten years.

c. In the annual report, management must acknowledge that they are required to have the company’s internal audit function attest to the accuracy of the annual reports.

d. All of the above.

e. None of the above.

Transcribed Image Text:

Exhibit 2.8 Significant Audit-Related Provisions of the Sarbanes-Oxley Act of 2002 TITLE I: Public Company Accounting Oversight Board 101 102 103 104 105 106 107 108 202 203 204 205 206 109 TITLE II: Auditor Independence 201 207 302 303 402 403 Establishment and administrative provisions. The Board: • Is a nonprofit corporation, not an agency of the US government • Will have five financially literate members who are prominent individuals of integrity and reputation with a commitment to the interests of investors and the public 404 • Has authority to set standards related to audit reports and to conduct inspections of registered public accounting firms 406 Registration with the Board. Accounting firms auditing public companies must register with the PCAOB. Auditing, quality control, and independence standards and rules. The Board will: • Establish or adopt rules regarding the conduct of audits and regarding audit firm quality-control standards. • Require audit firms to describe the scope of testing of issuers' internal control structure Inspections of registered public accounting firms. The Board will: • Inspect annually registered accounting firms that audit 100 or more issuers • Inspect at least every three years registered accounting firms that audit fewer than 100 issuers • Publicly report results of its inspections 407 Investigations and disciplinary proceedings. The Board will: • Adopt procedures for disciplining registered accounting firms • Require registered accounting firms to provide documentation and testimony that the Board deems necessary to conduct investigations • Be able to sanction registered accounting firms for noncooperation with investigations Foreign public accounting firms. Foreign accounting firms must comply with the same rules related to the PCAOB as domestic accounting firms. Commission oversight of the Board. The SEC has oversight and enforcement authority over the Board, including in processes involving standards setting, enforcement, and disciplinary procedures. Accounting standards. The SEC will recognize as GAAP that are established by a standard setter that meets the Act's criteria.. Funding. Registered accounting firms and issuers will pay for the operations of the Board. Services outside the scope of practice of auditors. There are a variety of services that registered accounting firms may not perform for issuers, such as bookkeeping, systems design, appraisal services, and internal auditing, among others. Tax services may be performed, but only with preapproval by the audit committee. Preapproval requirements. All audit and nonaudit services (with certain exceptions based on size and practicality) must be approved by the audit committee of the issuer. Audit partner rotation. The lead partner and reviewing partner must rotate off the issuer engagement at least every five years. TITLE III: Corporate Responsibility 301 Auditor reports to audit committees. Registered accounting firms must report to the audit committee issues concerning: • Critical accounting policies and practices • Alternative treatments of financial information within GAAP that have been considered by management, as well as the preferred treatment of the accounting firm • Significant written communications between the accounting firm and management Conforming amendments. This section details minor wording changes between the Sarbanes-Oxley Act and the Securities Act of 1934. Conflicts of interest. Registered accounting firms may not perform audits for an issuer whose CEO, CFO, controller, chief accounting officer, or other equivalent position was employed by the accounting firm during the one-year period preceding the audit. This is known as a cooling-off period. Study of mandatory rotation of registered public accounting firms. The Comptroller General of the United States shall conduct a study addressing this issue. Public company audit committees. • Audit committees are to be directly responsible for the appointment, compensation, and oversight of the work of registered accounting firms. TITLE IV: Enhanced Financial Disclosures 401 Disclosures in periodic reports. • Financial reports must be in accordance with GAAP and must reflect material correcting adjustments proposed by the registered accounting firm. • Each audit committee member shall be independent. • Audit committees must establish whistle-blowing mechanisms within issuers. • Audit committees have the authority to engage their own independent counsel. • Issuers must provide adequate funding for audit committees. Corporate responsibility for financial reports. The signing officers (usually the CEO and CFO): • Will certify in quarterly and annual reports filed with the SEC that the report does not contain untrue statements of material facts and that the financial statements and disclosures present fairly (in all material respects) the financial condition and results of operations of the issuer • Must establish and maintain effective internal controls to ensure reliable financial statements and disclosures • Are responsible for designing internal controls, assessing their effectiveness, and disclosing material deficiencies in controls to the audit committee and to the registered accounting firm Improper influence on conduct of audits. Officers of issuers may not take action to fraudulently influence, coerce, manipulate, or mislead the registered accounting firm or its employees. • Material off-balance sheet transactions and other relationships with unconsolidated entities or persons must be disclosed. • The SEC must issue new rules on pro forma figures and must study the issues of off-balance sheet transactions and the use of SPES. Enhanced conflict of interest provisions. Issuers may not extend credit to directors or executive offers. Disclosures of transactions involving management and principal stockholders. Requires that any director, officer, or shareholder who owns more than 10% of the company's equity securities publicly disclose that fact. Management assessment of internal controls. • Annual reports must state the responsibility of management for establishing and maintaining an adequate internal control structure and procedures for financial reporting. • Annual reports must contain an assessment of the effectiveness of the internal control structure and procedures of the issuer for financial reporting. • Each registered accounting firm must attest to and report on the assessment made by the management of the issuer, and such attestation must not be the subject of a separate engagement (in other words, requires an integrated audit). Code of ethics for senior financial officers. The SEC must issue rules requiring issuers to disclose whether or not the issuer has adopted a code of ethics for senior financial officers (and if not, the issuer must explain the rationale). Disclosure of audit committee financial expert. The SEC must issue rules to require issuers to disclose whether or not the audit committee of the issuer includes at least one member who is a financial expert (and if not, the issuer must explain the rationale).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

a The PCAOB was est...View the full answer

Answered By

S Mwaura

A quality-driven writer with special technical skills and vast experience in various disciplines. A plagiarism-free paper and impeccable quality content are what I deliver. Timely delivery and originality are guaranteed. Kindly allow me to do any work for you and I guarantee you an A-worthy paper.

4.80+

27+ Reviews

73+ Question Solved

Related Book For

Auditing A Risk Based Approach

ISBN: 9780357721872

12th Edition

Authors: Karla M Johnstone-Zehms, Audrey A. Gramling, Larry E. Rittenberg

Question Posted:

Students also viewed these Business questions

-

MULTIPLE-CHOICE QUESTIONS 1. What is the primary difference between fraud and errors in financial statement reporting? a. The materiality of the misstatement. b. The intent to deceive. c. The level...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Auditors who adhere to the professional auditing standards are viewed as conducting a quality audit. A lack of adherence to the professional auditing standards heightens the risk that the auditor...

-

If M is the midpoint of XY, find the coordinates of Y when X and M have the following coordinates: X(-4,2), M(0,3) Please write formulas too

-

True or false? a. Investors prefer diversified companies because they are less risky. b. If stocks were perfectly positively correlated, diversification would not reduce risk. c. Diversification over...

-

Explain the general nature of annuities and describe the manner in which they can help to deal with the retirement risk?

-

Describe how project managers use network diagrams and dependencies to assist in activity sequencing? LO.1

-

What are the advantages of establishing pay ranges, rather than specific pay levels, for each job? What are the drawbacks of this approach?

-

On October 1, 2021, Santana Rey launched a computer services company called Business Solutions, which provides consulting services, computer system installations, and custom program development. The...

-

When did the rapid development of the management science discipline begin?

-

A presumptive doubt mindset exists when the auditor neither believes nor disbelieves client management. (T/F)

-

Many consider the Enron fraud to be one of the most significant frauds of all time because it put pressure on the US government to act to safeguard the financial security of investors. a. Describe...

-

1) What does the story of the Chilean miners rescue suggest to you about the variety of ways that project management can be used in the modern world? 2) Successful project management requires clear...

-

Sams old friend Dot is considering setting up a business offering historical boating trips along the River Thames. Dot thinks that she may be able to make a good living out of this. She has carried...

-

Arrow Industries employs a standard cost system in which direct materials inventory is carried at standard cost. Arrow has established the following standards for the direct costs of one unit of...

-

Explain the financial effect (increase, decrease, or no effect) of each of the following transactions on stockholders' equity: a. Purchased supplies for cash. b. Paid an account payable. c. Paid...

-

What type of account-asset, liability, stockholders' equity, dividend, revenue, or expense-is each of the following accounts? Indicate whether a debit entry or a credit entry increases the balance of...

-

Is it possible for an accounting transaction to only affect the left side of the accounting equation and still leave the equation in balance? If so, provide an example.

-

How many justices are appointed to the Supreme Court? How many hear each case?

-

Wholesalers Ltd. deals in the sale of foodstuffs to retailers. Owing to economic depression, the firm intends to relax its credit policy to boost productivity and sales. The firms current credit...

-

On May 22, 2012, the audit firm of Brock, Schechter & Polakoff LLP (hereafter BSP) was censured and fined $20,000 by the PCAOB in relation to its audits of public companies located in Taiwan and...

-

The following is a description of various factors that affected the operations of Lincoln Federal Savings and Loan, a California savings and loan (S&L). It was a subsidiary of American Continental...

-

Important factors that lead auditors to assess inherent risk relating to financial reporting at a higher level relate to analyst following, including a history of exactly meeting analyst estimates,...

-

Suppose First Fidelity Bank engaged in the following transactions: (Click the icon to view the transactions.) Journalize the 2018 and 2019 transactions on First Fidelity's books. Explanations are not...

-

Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Beginning Balance Ending Balance Assets Cash Accounts receivable Inventory Plant and equipment, net...

-

Supply costs at Coulthard Corporation's chain of gyms are listed below: March April May June July August September October November Client-Visits 11,666 11,462 11,994 13,900 11,726 11, 212 12,006...

Study smarter with the SolutionInn App