In connection with his examination of the financial statements of the Olympia Manufacturing Company, a CPA is

Question:

In connection with his examination of the financial statements of the Olympia Manufacturing Company, a CPA is reviewing procedures for accumulating direct labor hours. He learns that all production is by job order and that all employees are paid hourly wages, with time-and-one-half for overtime hours.

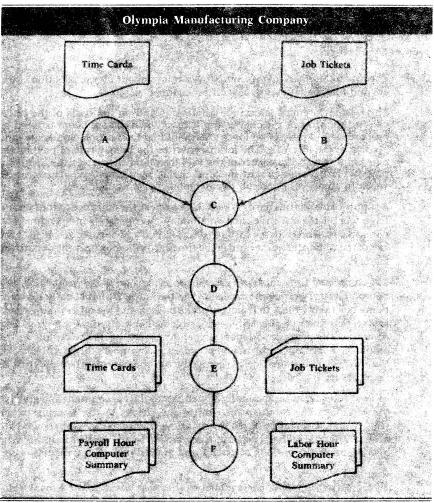

Olympia's direct labor hour input process for payroll and job cost determination is summarized in the flowchart:

Steps \(\mathrm{A}\) and \(\mathrm{C}\) are performed in timekeeping, step \(\mathrm{B}\) in the factory operating departments, step D in payroll audit and control, step E in data preparation (keypunch), and step F in computer operations.

Required:

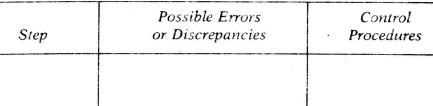

For each input processing step A through \(F\) :

a. List the possible errors or discrepancies that may occur.

b. Cite the corresponding control procedure for each error or discrepancy.

Note: Your discussion of Olympia's procedures should be limited to the input process for direct labor hours, as shown in steps A through \(F\) in the flowchart. Do not discuss personnel procedures for hiring, promotion, termination, and pay rate authorization. In step \(\mathrm{F}\) do not discuss equipment, computer program, and general computer operational controls.

Organize your answer for each input-processing step as follows:

Step by Step Answer:

Modern Auditing

ISBN: 9780471542834

5th Edition

Authors: Walter Gerry Kell, William C. Boynton, Richard E. Ziegler