Question: Nancy Miller, CPA, has completed field work for her examination of the financial statements of Nickles Manufacturers, Inc., for the year ended March 31, 19X1,

Nancy Miller, CPA, has completed field work for her examination of the financial statements of Nickles Manufacturers, Inc., for the year ended March 31, 19X1, and now is preparing her auditor's report. Presented below are three, independent, unrelated assumptions concerning this examination:

{Assumption 1}

The CPA was engaged on April 15, 19X1, to examine the financial statements for the year ended March 31, 19X1 and was not present to observe the taking of the physical inventory on March \(31,19 X 1\). Her alternative procedures included examination of shipping and receiving documents with regard to transactions during the year under review as well as transactions since the year end, extensive review of the inventory count sheets, and discussion of the physical inventory procedures with responsible Company personnel. She has also satisfied herself as to inventory valuation and consistency in valuation method. Inventory quantities are determined solely by means of physical count. (Note: Assume that the CPA is properly relying upon the examination of another auditor with respect to the beginning inventory.)

{Assumption 2}

As of April 1, 19X1, Nickles has an unused balance of \(\$ 1,378,000\) of federal income tax net operating loss carryover that will expire at the end of the Company's fiscal years as follows: \(\$ 432,000\) in \(19 X 2, \$ 870,000\) in \(19 X 3\), and \(\$ 76,000\) in \(19 \times 4\). Nickles' management expects that the Company will have enough taxable income to use the loss carryover before it expires.

{Assumption 3}

On February \(28,19 \times 1\). Nickles paid cash for all of the outstanding stock of Ashworth, Inc., a small manufacturer. The combination was consummated as of that date and has been appropriately accounted for as a purchase.

{Required:}

For each assumption described above, discuss the following:

a. In detail, the appropriate disclosures, if any, in the financial statements and accompanying footnotes.

b. The effect, if any, on the auditor's standard report. For this requirement assume that Nickles makes the appropriate disclosures.

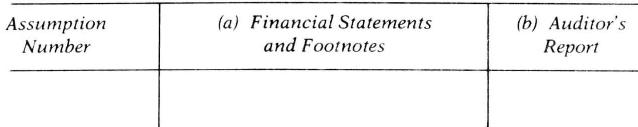

Note: Complete your discussion of each assumption (both a and \(\mathrm{b}\) above) before beginning discussion of the next assumption. In considering each independent assumption, assume that the other two situations did not occur. Organize your answer sheet as follows:

Assumption Number (a) Financial Statements and Footnotes (b) Auditor's Report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts