E-Antiques, Inc., is an Internet-based market for buyers and sellers of antique furniture and jewelry. The company

Question:

E-Antiques, Inc., is an Internet-based market for buyers and sellers of antique furniture and jewelry. The company allows sellers of antique items to list descriptions of those items on the E-Antiques website. Interested buyers review the website for antique items and then enter into negotiations directly with the seller for purchase.

E-Antiques receives a commission on each transaction.

The company, founded in 2019, initially obtained capital through equity funding provided by the founders and through loan proceeds from financial institutions. In early 2022, E-Antiques became a publicly held company when it began selling shares on a national stock exchange. Although the company had never generated profits, the stock offering generated large proceeds based on favorable expectations for the company, and the stock quickly increased to above $100 per share.

Management used the proceeds to pay off loans to financial institutions and to reacquire shares issued to the company founders. Proceeds were also used to fund purchases of hardware and software used to support the online market. The balance of unused proceeds is currently held in the company’s bank accounts.

Required

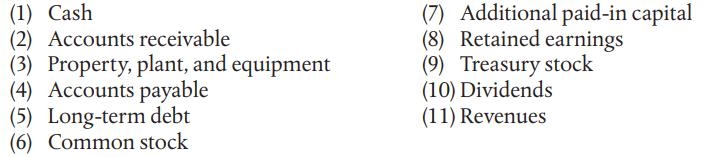

a. Before performing analytical procedures related to the capital acquisition and repayment cycle accounts, consider how the process of becoming publicly held will affect accounts at E-Antiques, Inc. Describe whether each of the following balances would have increased, decreased, or experienced no change between 2021 and 2022 because of the public offering:

b. During 2023, the stock price for E-Antiques plummeted to around $19 per share. No new shares were issued during 2023. Describe the impact of this drop in stock price on the following accounts for the year ended December 31, 2023:

(1) Common stock.

(2) Additional paid-in capital.

(3) Retained earnings.

c. How does the decline in stock price affect your assessment of client business risk and acceptable audit risk?

Step by Step Answer:

Auditing And Assurance Services An Integrated Approach

ISBN: 9780137879199

18th Edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Chris E. Hogan