Your firm has decided to try two approaches to estimating a valuation allowance for sales returns. Required: a. First, your firm decides to estimate that

Your firm has decided to try two approaches to estimating a valuation allowance for sales returns.

Required:

a. First, your firm decides to estimate that 10% of all sales will eventually be returned. Using the data provided and the monthly returns information above, estimate the allowance for sales returns as of 1/31/2021.

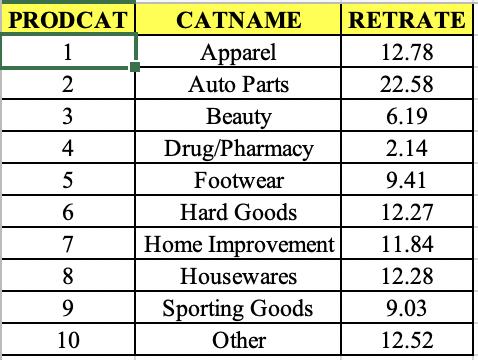

b. Second, your firm decides to use the return percentage information acquired from the auditor specialist. Using the data provided and the monthly returns information above, estimate the allowance for sales returns as of 1/31/2021.

Jerry’s Discount Supplies, Inc. (JDS) is a regional discount retailer that operates large discount stores in the southeastern United States. They compete directly in their markets with other discount stores. One hallmark of JDS is their generous return policy which allows customers to return any item at any time within 90 days for a full refund. JDS is also notable because they are much smaller in terms of number of stores – they only have 20 stores throughout the region. Similar to many retailers, JDS uses an end of January fiscal year end to allow for less uncertainty in holiday season sales returns.

Although JDS allows customers great leniency in their return policy, their return rates have traditionally been in line with other retailers, and they estimate that approximately 5% of their returns are fraudulent, which is also in line with other retailers. This makes estimation of their sales return allowances reasonably predictable, according to company management.

JDS reports that historically, approximately 10% of all sales are returned. 70% of these returns occur in the month immediately following the sale, 25% occur within the next month, and the remaining 5% mostly happen in the third month. Later returns are immaterial since they are not according to policy. JDS estimates their returns using an “analysis of economic conditions, historical average returns, as well as a variety of other sources”. Because this method is difficult to validate and is not as precise as your firm prefers, your firm has decided to test the estimate by preparing an estimate and comparing it to the client’s using data collected from other sources on return rates, as well as using subsequent client information.

Whenever an auditor uses Information Prepared by the Entity, that information must be tested for completeness and accuracy. For the purposes of the following exercises, please assume that your firm has already tested the completeness and accuracy of the Product Sales Summary and the Product Returns Summary and has determined that the amounts reported by the company are reasonable for purposes of your test of the sales return allowance account.

You have been assigned to audit the sales return and allowance account for JDS Retail for the fiscal year ended 1/31/2021. You have been provided with the following information:

- Information for use with JDS Retail document

- Return Rates database

- Product Sales Summary database for November, 2020 – January, 2021

- Product Returns Summary database for November, 2020-January, 2021

- The client G/L reports an Allowance for Sales Returns of $3,100,000 as of 1/31/2021.

- Your firm has set materiality for the Allowance for Sales Returns account at $1,200,000

- For the purposes of this exercise, assume that sales occur uniformly throughout the year and month and that all months have 30 days.

PRODCAT 1 234 2 5 6 7 8 9 10 CATNAME Apparel Auto Parts Beauty Drug/Pharmacy Footwear Hard Goods Home Improvement Housewares Sporting Goods Other RETRATE 12.78 22.58 6.19 2.14 9.41 12.27 11.84 12.28 9.03 12.52

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down the steps to estimate the allowance for sales returns using the two approaches menti... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards