Your firm is responsible for auditing the financial statements of Hucknall Manufacturing Ltd. for the year ended

Question:

Your firm is responsible for auditing the financial statements of Hucknall Manufacturing Ltd. for the year ended November 30. The company operates from a single site. Its sales are $5 million and the profit before tax is $110,000. There are no inventory records, so the inventory counts at year end will be used to value the inventory in the financial statements. Because Monday, November 30, is a normal working day, it has been decided that the inventory count should take place on Sunday, November 29, when there is no movement of inventory.

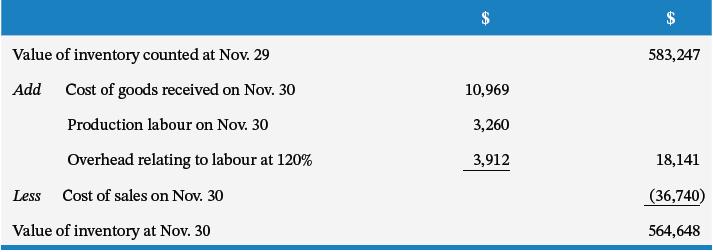

The company has produced the following schedule to determine the value of inventory at November 30, from that counted on November 29.

The company keeps basic accounting records using a standard software package. The following accounting procedures are used for sales, purchases, and wages.

1. The shipping department creates shipping documents when the goods are sent to customers. Sales invoices are produced based on the shipping documents. Sales invoices are input into the computer, which posts them to the accounts receivable ledger and the general ledger.

2. When goods are received, a receiving report is prepared. Purchase invoices are matched with the receiving reports and purchase orders, and authorized by the chief executive officer. After the purchase invoices have been authorized, they are input into the computer, which posts them to the accounts payable ledger and the general ledger.

Required

a. Describe the audit procedures you should perform to verify the accuracy of the inventory count:

i. before the inventory count ii. on the day of the inventory count Include details of the matters you should record in your working papers for follow-up at the final audit.

b. Explain the substantive procedures you should perform to check the company’s schedule (as shown above) that adjusts the value of inventory at November 29, to that at the company’s year end of November 30. You are required to verify only the total value of inventory of $564,648 at November 30.

You are not required to describe the procedures necessary to verify the accuracy of the individual values of raw materials, work in process, or finished goods.

c. Describe the substantive procedures you should perform to check purchases cut-off at the year end.

Step by Step Answer:

Auditing A Practical Approach

ISBN: 9781119709497

4th Canadian Edition

Authors: Robyn Moroney, Fiona Campbell, Jane Hamilton, Valerie Warren