Question:

Brown and Collins, a firm of chartered accountants, is auditing the financial statements of Globe Ltd for the year ended 31 December 20X1. Tom Brown, the engagement audit partner, anticipates expressing an unqualified opinion on 20 May 20X2.

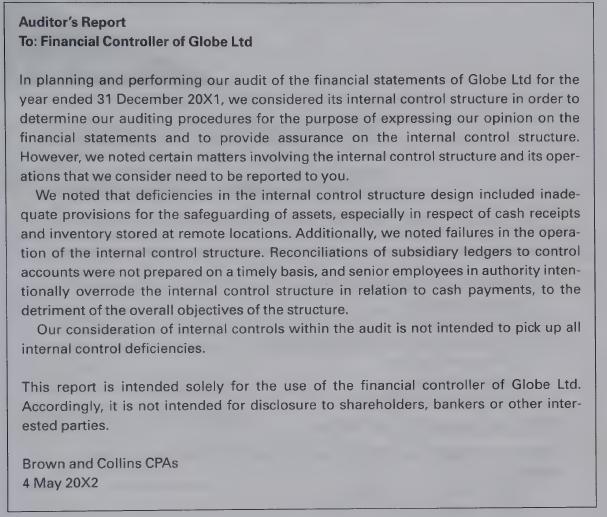

Jane Grieves, an audit assistant on the engagement, drafted the auditor’s management letter that Tom Brown plans to send to Globe Ltd along with the 20 May financial statements.

Tom Brown reviewed Jane Grieves’s draft and said there were some deficiencies. The draft was as shown below.

Required

Indicate any deficiencies in the draft management letter prepared by Jane Grieves.

Transcribed Image Text:

Auditor's Report To: Financial Controller of Globe Ltd In planning and performing our audit of the financial statements of Globe Ltd for the year ended 31 December 20X1, we considered its internal control structure in order to determine our auditing procedures for the purpose of expressing our opinion on the financial statements and to provide assurance on the internal control structure. However, we noted certain matters involving the internal control structure and its oper- ations that we consider need to be reported to you. We noted that deficiencies in the internal control structure design included inade- quate provisions for the safeguarding of assets, especially in respect of cash receipts and inventory stored at remote locations. Additionally, we noted failures in the opera- tion of the internal control structure. Reconciliations of subsidiary ledgers to control accounts were not prepared on a timely basis, and senior employees in authority inten- tionally overrode the internal control structure in relation to cash payments, to the detriment of the overall objectives of the structure. Our consideration of internal controls within the audit is not intended to pick up all internal control deficiencies. This report is intended solely for the use of the financial controller of Globe Ltd. Accordingly, it is not intended for disclosure to shareholders, bankers or other inter- ested parties. Brown and Collins CPAs 4 May 20X2