You are the audit senior for the 2018 yearend audit of Vision Quest (VQ), a publicly traded

Question:

You are the audit senior for the 2018 yearend audit of Vision Quest (VQ), a publicly traded Canadian company that is one of the largest and fastest online vision care providers in the world. Because of the efficiencies of the internet to bypass middlemen, VQ has a significant competitive advantage in its market. You are responsible for auditing the revenue cycle. Performance materiality for the VQ audit is $100 000. VQ?s year-end is October 31, 2018.

Below is a summary of key information regarding the revenue cycle:

Revenue Recognition Policy?Revenue from product sales is recognized when the product has been shipped to the customer. At that point, the amount of sales revenue is determinable, no significant vendor obligations remain, and the collection of the revenue is reasonably assured. A provision is made for product returns. Revenue collected in advance of the product being shipped is deferred.

Audit Strategy for Revenue?The audit strategy relies upon tests of controls (including substantive tests of transactions) and substantive analytical procedures. No accounts receivable confirmations are sent out. Your audit team has tested controls related to revenue transactions and concluded that controls are effective and support the control risk assessment of low for the revenue transaction-related assertions.

Change in Credit Policy?When reviewing the accounts, you noted that a new account, allowance for doubtful accounts, has been set up. Upon investigation, you find that in February 2018, VQ implemented a program where the majority of customers were granted credit. VQ developed this program to attract new customers who might be wary of ordering contact lenses from an online retailer and having to pay for them prior to receiving them. The company?s program, named ?Invoice Me Later? or ?the IML program,? allows customers to order from VQ and pay after receiving the product. Management estimates payment should generally be received in less than 15 days.

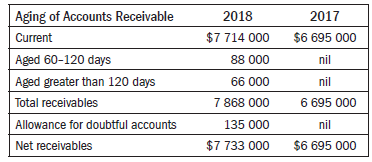

Estimate for Allowance for Doubtful Accounts?The majority of the balances outstanding are less than $150 and there are a large number of records. Management estimates an allowance based upon the aging of the receivable portfolio. Below is a summary of the aging and management?s estimate for the allowance for doubtful accounts.

REQUIRED

a. Explain the impact of the IML program on your audit strategy for the revenue cycle of VQ. (Use the audit risk model and assertions to support your analysis.)

b. Do you agree with the auditors? decision not to send out accounts receivable confirmations? Why or why not?

c. If the auditors planned to send out accounts receivable confirmations, what type of confirmations would you recommend? Explain why.

Step by Step Answer:

Auditing The Art and Science of Assurance Engagements

ISBN: 978-0134613116

14th Canadian edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Joanne C. Jones