Flash Technologies, Inc. has recently engaged your firm to perform the annual audit for the year ending

Question:

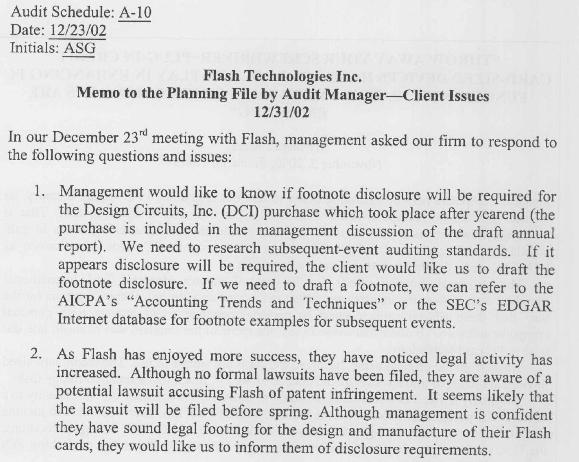

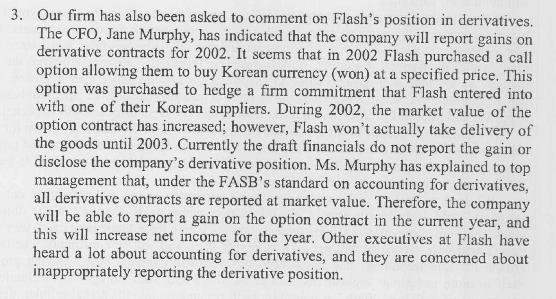

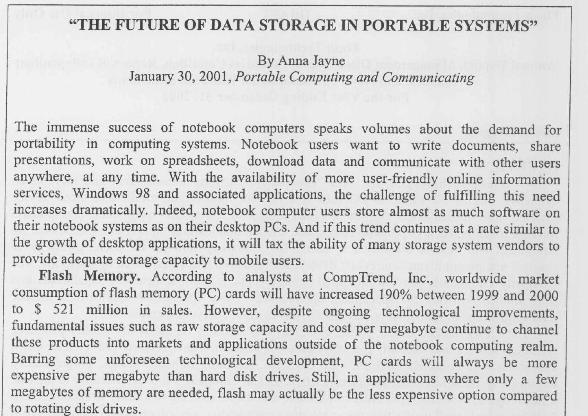

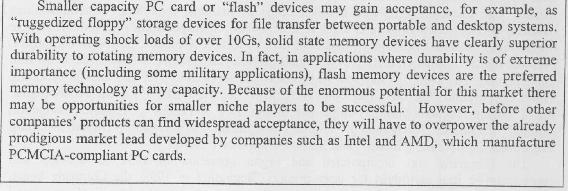

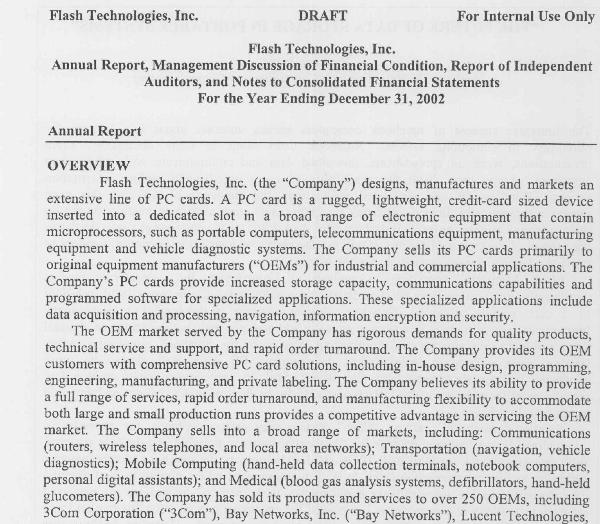

Flash Technologies, Inc. has recently engaged your firm to perform the annual audit for the year ending December 31, 2002. Flash has determined that their current auditors, Adams \& Adams LLP, cannot provide the international support that Flash now requires with their increased investment in Korea and Canada. Partners from your firm have discussed the prior audits with the engagement partner at Adams \& Adams, and everything seems to be in order. Your firm also met with executives at Flash in December 2002 and a verbal (but informal) agreement was reached regarding fees, timing, scope etc. Your firm has decided that additional analyses are needed before finalizing the details of the engagement (assume that it is now January 2003). On the following pages you will find (1) two memos from the audit manager of your firm to the planning files regarding background information and questions/concerns the client would like the firm to address, (2) industry articles, (3) industry ratios, and (4) the draft annual report for fiscal year 2002 that Flash has prepared.

REQUIREMENTS

1. Provide written recommendations in response to the issues the client has identified (see the "Client Issues" audit memo).

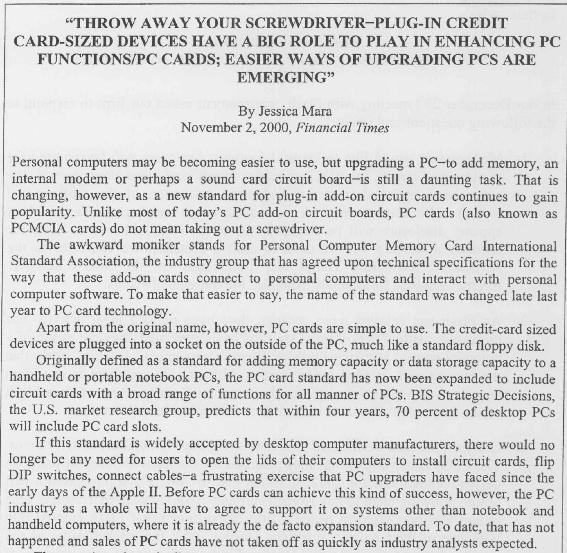

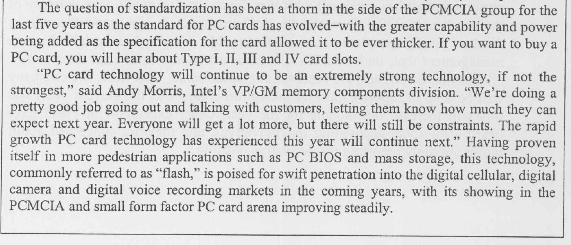

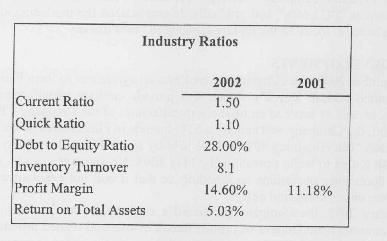

2. Perform a risk analysis and document your findings in a written report. A report like this would be used as a foundation document for engagement planning and client meetings. Using only the information provided in the case (e.g., memos, annual report, and articles) describe the key business risks Flash faces and the key audit risks posed to your audit firm by Flash. (Please focus primarily on factors that will influence acceptable audit risk and inherent risk.) In describing the key inherent risks, please be sure to discuss why a factor represents a risk, and then briefly discuss what implications that particular risk will have on the audit. Auditors are required to specifically assess the risk of material misstatement whether caused by error or fraud. The following AICPA Professional Standards may be useful references for your risk analysis: AU 311, "Planning and Supervision," AU 312, "Audit Risk and Materiality in Conducting an Audit," and 316, "Consideration of Fraud in a Financial Statement Audit." To help you identify critical risk factors, you may also wish to perform analytical procedures based on the company's financial data and general industry ratios.

Your firm demands polished, concise, professional analyses and writing. Be thorough, but get to the issues without unnecessary verbiage. In describing your analyses and conclusions, please consider relatively short, "punchy" or to-the-point sentences. Paragraphs will probably not contain more than about 5 sentences. You may want to organize your risk analysis around categories like General Areas of Risk (e.g., foreign ventures, etc.), Industry Risks, and Specific Financial Statement Risks (e.g., significant or unusual increases in ending balances). Please use headings appropriately and consider using bullet point listings. Exhibits should be referred to in the body of the report and should not include unnecessary detail. Your instructor will provide further guidance on the length and format of the report.

Step by Step Answer:

Auditing Cases An Active Learning Approach

ISBN: 9781266566899

2nd Edition

Authors: Mark S. Beasley, Frank A. Buckless, Steven M. Glover, Douglas F. Prawitt