Section 404 of the Sarbanes- OxleyAct of2002 requires public companies to report on the effectiveness of their

Question:

Section 404 of the Sarbanes- OxleyAct of2002 requires public companies to report on the effectiveness of their internal control over financial reporting. Section 404 also requires companies to hire an auditor to perform an “integrated audit” involving both a traditional financial statement audit and an audit of internal control over financial reporting. PCAOB Audit Standard No. 5, An Audit of Internal Control Over Financial Reporting That Is Integrated with An Audit of Financial Statements (AS5), provides guidance for the audit of internal control and requires the auditor to obtain sufficient competent1 evidence about the effectiveness of controls for all relevant assertions related to all significant accounts in the financial statements. Before an auditor can identify which controls to test, some important audit decisions need to be made. Some of these decisions are listed below.

■ Identify Significant Accounts. Significance is determined by applying quantitative and qualitative measures of materiality to the consolidated financial statements.

■ Identify Relevant Financial Statement Assertions. For each significant account, relevant assertions are identified by considering the assertions that have a meaningful bearing on whether the account is fairly stated. Relevant assertions are those assertions (one or more) related to significant accounts that, if inaccurate, present a reasonable possibility of containing a misstatement or misstatements that would cause the financial statements to be materially misstated.

■ Identify Significant Processes and Major Classes of Transactions. The auditor must understand relevant processing procedures involved in the flow of transactions for significant accounts. The controls auditors will test reside within the significant transaction processes (e.g., sales and collection cycle, period-end financial reporting process). Once significant accounts, relevant assertions, and significant processes have been identified, the auditor identifies the controls to test. Determining the location where testing will occur is not always a simple decision. Significant accounts at the consolidated company level are an aggregation of the accounts at the company’s various business units, which may be geographically dispersed across several locations. For example, consolidated accounts receivable is the aggregation of the accounts receivable balances at each of the company’s individual business units (i.e., locations, divisions, or subsidiaries). Thus, another important logistical decision the auditor must make for each significant account is to determine which business units to visit in order to test the controls pertaining to the account.

AS5 does not require the auditor to visit all of a company’s business units or locations. Rather, AS5 requires the auditor to gather sufficient competent evidence for each significant account at the consolidated level in order to support his or her opinion regarding management’s assertion about the effectiveness of internal control over financial reporting. To illustrate, suppose a company has ten different business units, each of which has accounts receivable. Assuming accounts receivable is deemed to be a significant account at the consolidated company level, the auditor may appropriately decide to test controls over accounts receivable at the company’s six largest locations, representing 75 percent of the total consolidated receivables balance.

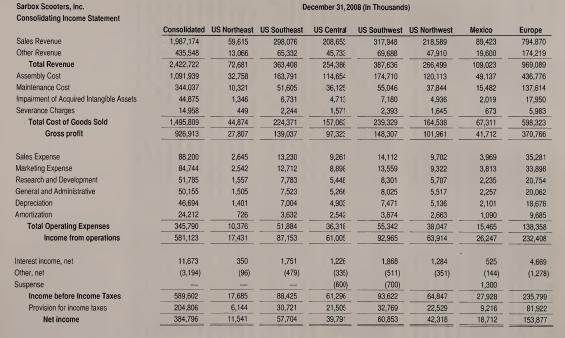

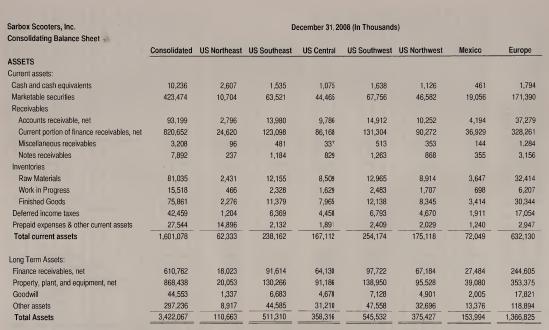

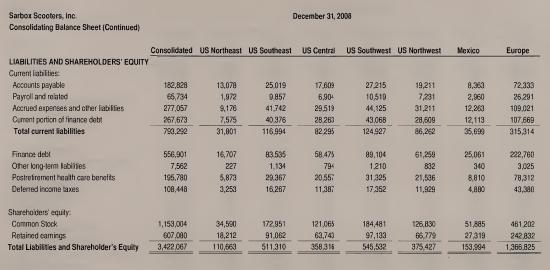

Part A of this case asks you to identify significant accounts and to determine which locations you would visit to perform tests of controls for Sarbox Scooter, Inc., a hypothetical manufacturer of scooters and mini-motorcycles. Completing the requirements of Part A involves a number of fairly involved judgments and decisions. However, you are provided with guidance that will walk you through each step.

Part B of this case, which can be completed independently of Part A, asks you to evaluate the likelihood and magnitude of control deficiencies as defined and required by AS5. When a deficiency is deemed to be a material weakness, the auditor issues an adverse opinion with respect to the effectiveness of a company’s controls over financial reporting. Approximately 14 percent of the first wave of companies required to comply with Section 404 (known as “accelerated filers”) received an adverse audit opinion in early 2005 due to material weaknesses............

[1] Section 404 of the Sarbanes-Oxley Act of 2002 requires management to assess and evaluate the effectiveness of their internal controls. Management of Sarbox has decided to consider all accounts reported in the financial statements as significant. The PCAOB’s AS5 requires the auditor to arrive at their own conclusion about which accounts are significant as part of evaluating management’s assessment. Refer to Delmoss Watergrant’s policy on identifying significant accounts and Sarbox Scooter Inc.’s consolidated balance sheet and income statement information to identify Sarbox’s significant accounts. In your response, include the planning materiality threshold you applied (to determine materiality you may refer to your textbook or footnote 1 in Delmoss Watergrant’s policy on identifying significant accounts). If an account is considered significant for qualitative, but not quantitative reasons, please include the qualitative factors you considered. Similarly, if an account is not considered significant, even though it is quantitatively over the planning materiality threshold, please include the qualitative factors you considered.

[2] Section 404 of the Sarbanes-Oxley Act of 2002 requires management to assess and evaluate the effectiveness of their internal controls. Sarbox’s management has decided to consider every location as a significant location. The auditor must arrive at his or her own assessment as to which locations should be tested. Referring to Delmoss Watergrant’s policy on identifying significant locations and Sarbox Scooter Inc.’s financial information by location, identify Sarbox’s individually significant locations. If a location is considered significant for qualitative, but not quantitative reasons, please include the qualitative factors you considered.

[3] Referring to Delmoss Watergrant’s policy on coverage by account and location, determine if adequate coverage of all significant accounts is achieved by testing at the significant locations. If not, what additional testing do you recommend?

[4] Auditing standards require the identification and testing of entity level controls. What are examples of entity-level controls? What are the auditor’s responsibilities with respect to evaluating and testing a client’s period-end financial reporting process?

[5] What are the definitions of a control deficiency, significant deficiency, and material weakness as contained in AS5? Which, if any, of these deficiency categories must the external auditor include in the audit report?

[6] Referring to Delmoss Watergrant’s policy for evaluating control deficiencies, determine if the following three deficiencies represent a control deficiency, a significant deficiency, or a material weakness. Please consider each case separately and justify your answers.

[a] While examining Sarbox’s period-end financial reporting process, you discover that revenue has been recognized on orders that were received and completed, but not yet shipped to the customer. No specific goods were set aside for these orders; however, there is sufficient inventory on hand to fill them. Also, you observe that some orders were shipped before being recorded as sales, so that your best estimate of total revenue cutoff error at year-end was approximately $2.3 million.

[b] Sarbox’s revenue recognition policy requires that all nonroutine sales (i.e. sales to clients other than dealerships) receive authorization from management in order to verify proper pricing and terms of sale. However, after examining a sample of nonroutine sales records you find that this control is not closely adhered to and that sales representatives offered discounts or altered sales terms that were not properly recorded in Sarbox’s records. As a result, in instances when the control is not followed the recorded sales prices tend to be too high and/or terms are not correctly reflected in the sales invoice and the customers complain. In some situations, customers have cancelled orders due to the over-billing or changed sales terms. Nonroutine sales represent about 10% of Sarbox’s sales revenue. From your sample testing of the authorization control, you find that the control doesn’t operate 4% of the time, with an upper bound of 9% (i.e., based on your sample, you can be 95% confident that the exception rate does not exceed 9%).

[c] Sarbox Scooter requires that all credit sales to new customers or to customers with a current balance over their pre-approved credit limit be approved by the credit manager prior to shipment. However, during peak seasons this policy is not strictly followed in order to accommodate the need of both the company and its customers to have orders processed rapidly. Because of these findings, you estimate that the allowance for doubtful accounts is materially understated. While the client does not dispute that the authorization control was not operating effectively during peak seasons, the client has pointed out compensating controls that it feels should reduce the magnitude ofthe deficiency below a material weakness. The first compensating control is that an accounts receivable aging schedule is reviewed each quarter by management and accounts that are older than 180 days are written-off. Also, management distributes a list of companies that default or fail to pay on time to all sales staff on a monthly basis to prohibit such companies from making additional purchases on credit.

Step by Step Answer:

Auditing Cases An Interactive Learning Approach

ISBN: 978-0132423502

4th Edition

Authors: Steven M Glover, Douglas F Prawitt