St. James Clothiers is a high-end clothing store located in a small Tennessee town. St. James only

Question:

St. James Clothiers is a high-end clothing store located in a small Tennessee town. St. James only has one store, which is located in the shopping district by the town square. St. James enjoys the reputation of being the place to buy nice clothing in the local area. The store is in its twentieth year of operation.

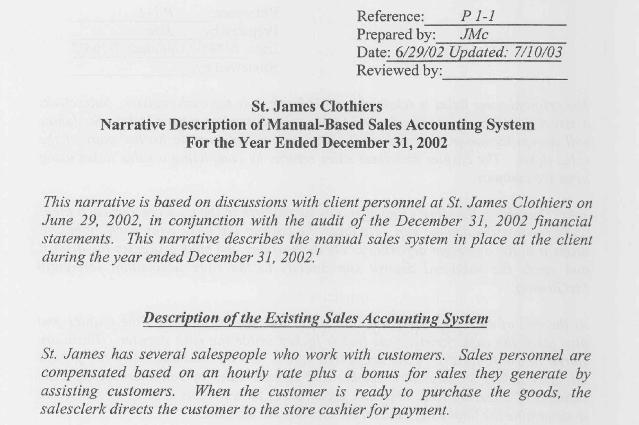

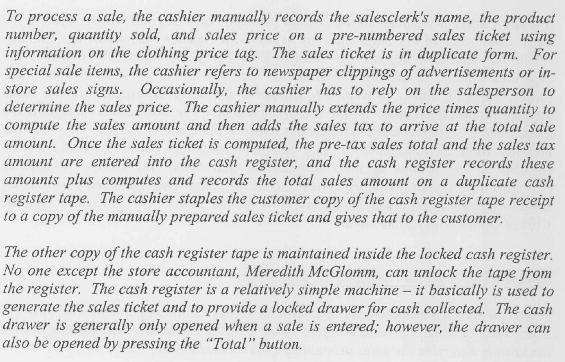

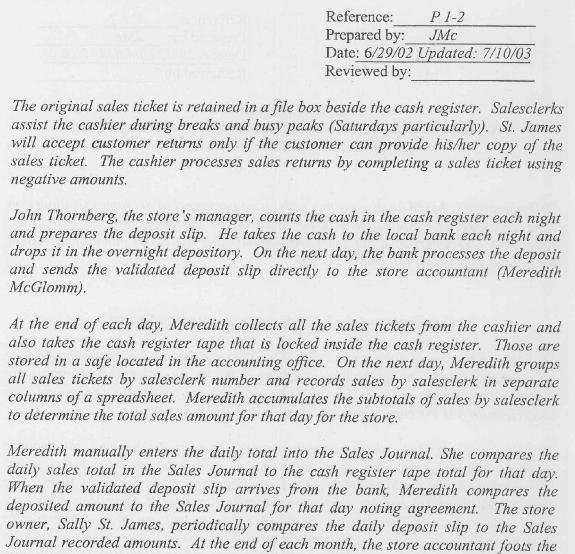

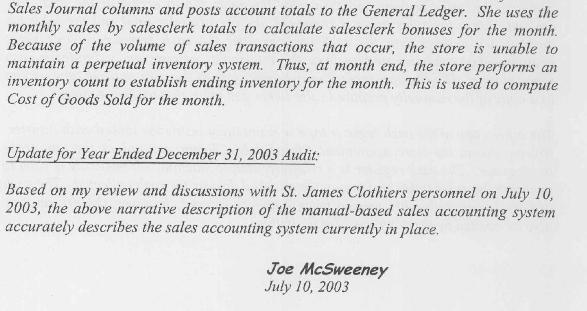

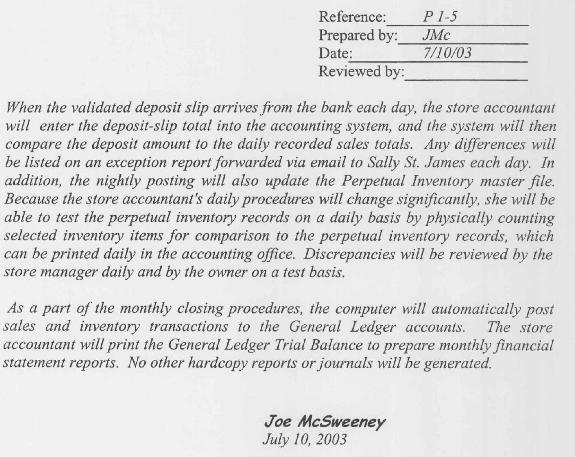

The owner, Sally St. James, recently decided to convert from a relatively simple manual sales system to an IT-based sales application package. The sales application software will be purchased from a software vendor. As the audit senior on the St. James engagement, you recently asked one of your staff auditors, Joe McSweeney, to visit with the client more formally to learn more about the proposed accounting system change. You asked Joe to review the narrative in last year's audit files that he prepared, which describes the existing manual sales accounting system, and update it for any current-year changes. You also asked him to prepare a second narrative describing the proposed IT-based sales accounting system, using information he obtained in his discussions with St. James personnel. The narrative from last year's audit files as well as the narrative recently prepared by Joe are provided in the pages that follow.

REQUIREMENTS

The audit partner on the St. James engagement, Betty Watergate, has asked you to review the narratives prepared by Joe as part of your audit planning procedures for the current year's December 31, 2003 financial statement audit. Betty wants you to prepare a memorandum for her that addresses these questions:

1. What aspects of the current manual sales accounting system create risks that increase the likelihood of material misstatements in the financial statements? Specifically identify each risk and how it might lead to a misstatement. For example, don't just put "Risk: Sales tickets are manually prepared by the cashier." Rather, you should state why this increases risks of material misstatements by adding "This increases the risk of material misstatements because it increases the risk of random mathematical errors by the cashier."

2. What features, if any, of the proposed IT-based sales accounting system will help minimize the risks identified in question 1? If a weakness exists that will continue with the new system, indicate that "no computer controls reduce this risk."

3. How does the IT-based sales system create new risks for material misstatements?

4. What recommendations do you have related to plans for the actual conversion to this new system?

Prepare a memorandum containing your responses to Betty's questions. You may find it helpful to combine your responses to questions 1 and 2. For example, you might present your answers under these headings: Risks; How Risks Impact Financial Statements; and New IT System Mitigating Factors.

Step by Step Answer:

Auditing Cases An Active Learning Approach

ISBN: 9781266566899

2nd Edition

Authors: Mark S. Beasley, Frank A. Buckless, Steven M. Glover, Douglas F. Prawitt