It is going to be a long night! First thing this morning, the senior partner of your

Question:

It is going to be a long night! First thing this morning, the senior partner of your three-partner firm, Peters, Peters, and Paul (PPP), called you into her office to tell you that she had a confidential but exciting assignment for you. The firm has been retained to review the audit working papers of another firm in connection with its audit of TVB Software (TVB), a public company. That firm, Yeller, Louder, and Soft (YLS), had performed the audit of TVB for the last two years, since the date it went public. It appears that the bank did not renew TVB's loan when it matured some six months ago, and TVB was unable to obtain other financing. As a result, your firm's client lost a good portion of the $2 million he had invested in the shares of TVB. Your client is suing the auditors of TVB, alleging that they failed to perform the audit in accordance with GAAS and that as a result, your client relied on financial statements that were not correct when he made his decision to hold on to his TVB shares. The last audited statements are included in Exhibit EP 3A-3-1.

Victoria Smyth, the partner, has reviewed the contents of YLS's working papers. Her notes are in Exhibit EP 3A-3-2. You have been asked to review these notes and prepare a report identifying any departures from GAAS to support your client's view that the audit was not conducted in accordance with GAAS. In this regard, you should note whether each instance is a clear departure from GAAS or whether the matter is grey and, therefore, subject to potential challenge in court. Victoria is also concerned that your firm may have some professional responsibilities under the Rules of Professional Conduct in connection with this agreement. She would like you to identify these for her.

Required

Prepare the report requested by Victoria Smyth.

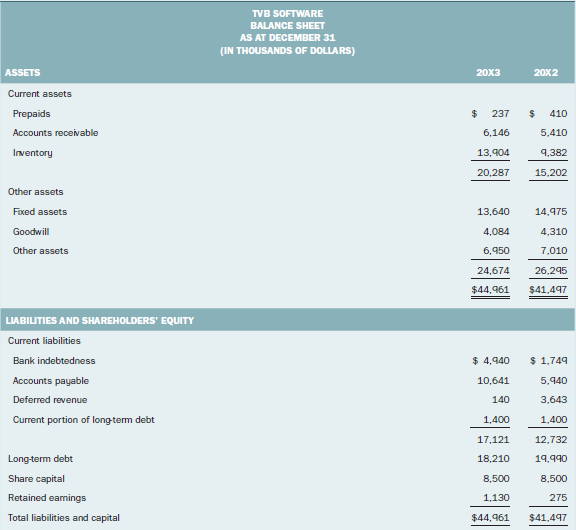

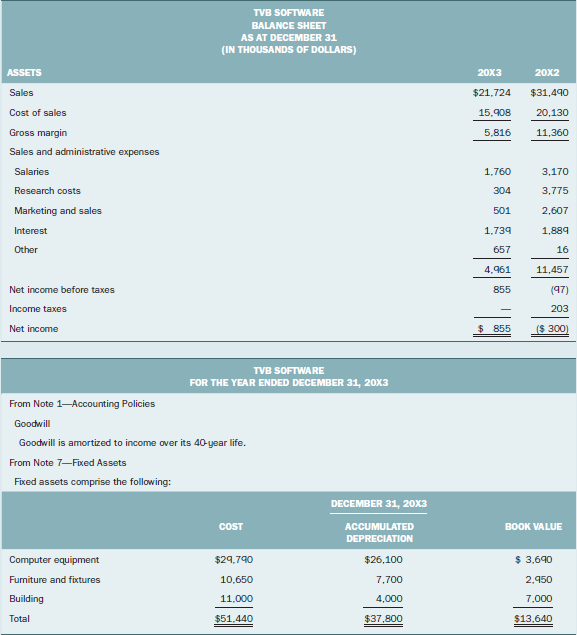

EXHIBIT EP 3A-3–1

EXHIBIT EP 3A-3–1

Extracts from Audited Financial Statements

EXHIBIT EP 3A-3-2

TVB Software

"PRIVILEGED" Victoria Smyth's notes on the review of audit working papers of TVB Software prepared by Yeller, Louder, & Soft

1. I reviewed YLS's working papers at their office. The audit report for the year ended December 31, 20X3, was signed by YLS on February 20, 20X4.

The working papers were neat and appeared to be well organized. All of the files have been prepared by audit staff and have been reviewed by a YLS junior audit partner, though not the one who signed the financial statements. This is the only public company audited by YLS.

I asked to review the files of the previous year but was told that YLS only retains one year of files. The 20X2 files had been destroyed. I reminded YLS that the 20X2 files had now been subpoenaed by the Court.

2. The audit was staffed by two YLS PAs. Neither had performed audits of a software company before, but one of them had several years of auditing experience. The other PA had recently qualified and had spent the previous two years working for a government internal auditor's department. The audit partner told me that he was not concerned about this other PA because he was related to TVB's CFO and, hence, had a good knowledge of some of the workings of the company.

3. The audit was fully substantive in nature. All three of YLS's files contain working papers documenting the results of its substantive testing. Each section of the work contains a checklist of substantive tests. The tests appear to have been developed specifically for this assignment. The steps on the checklists appear to be signed off and cross-referenced to the appropriate working papers.

4. The first file is called the "TOP FILE" and contains several memos to file. The most significant of these are as follows:

(a) Materiality: A short memo sets materiality at $400,000. The memo notes that the company is not currently profitable although it is expected to be in the near future. As a result, it is more appropriate to use balance sheet numbers to determine materiality. Once the company becomes profitable, YLS would expect to use normalized income as a basis for materiality. Thus, 1% of total assets is approximately $400,000.

(b) Plan: A short memo sets out that the audit will be fully substantive against a materiality of $400,000 and follow the approach used in the previous year, including the tailored audit programs developed that year.

(c) Engagement letter, signed by the client.

(d) Legal letters to each of TVB's lawyers, each with a standard reply.

(e) A standard management representation letter, containing no unusual or tailored paragraphs.

5. Prepaids: As these amounts were not material, YLS only compared this year's schedule to that of the previous year. There were no unusual items on either of the schedules.

6. Accounts receivable: The audit work in this section included a confirmation of the 15 largest accounts and 10 other accounts selected at random, covering 79% of the population. All but two of the confirmations (totalling $326,000) were received back with no problems noted. In view of the satisfactory result on the other confirmations, no additional procedures were carried out in relation to these two items.

A review was done to identify subsequent payments, and as at the date of the audit opinion, 85% of the receivables had been collected. Of the remaining accounts, none were above $100,000, so no further work was carried out.

Procedures were carried out to ensure that balances outstanding at year-end related to shipments before year-end. These procedures included agreeing amounts to invoices and shipping documents.

7. Inventory: The inventory consisted of software packages, most of which were manufactured by TVB, and some purchased for modification and resale.

YLS attended the inventory count at year-end and reviewed the procedures necessary to achieve a proper cutoff. As a result of these procedures, YLS found cutoff errors that resulted in an overstatement of sales of $182,500. They concluded that as this amount was not material, no adjustment was necessary. They also reviewed the inventory valuation by reviewing the process for allocating costs to specific products. This is a very complex process, and the audit work seems to be detailed and thorough, with much recomputation and testing in the files. They concluded that the allocation methodology was appropriate under the circumstances. They did not identify any errors.

8. Fixed assets: YLS's work was limited to reviewing the schedule of purchases (there were none above $100,000) and recomputing the depreciation for the year.

9. Goodwill: YLS recomputed the amortization for the year.

10. Bank indebtedness: YLS confirmed the amount of the bank indebtedness and the long-term debt, which is also owing to the bank. The confirmation noted that the debt was up for renewal in June of the following year.

There is a note in the file that company management was confident that the debt would be renewed for a five-year term. As well, the file contained copies of some internal TVB memoranda, written over a four-month period in 20X3, summarizing management's meetings with the bank and supporting the view that the debt would likely be renewed. On this basis, YLS concurred with management’s view that the debt should continue to be classified as long-term debt.

11. Accounts payable: The files contained a confirmation of 100% of the accounts payable. All of the replies were in the file and all discrepancies had been followed up. As a result of these procedures, YLS concluded that accounts payable were understated by $232,000 but that as this amount was immaterial, no adjustment was required.

12. Income taxes: Very detailed work was carried out in this section by a tax manager from YLS. The review appears very thorough, and amounts are reconciled down to the penny.

13. Profit and loss: YLS carried out analytical procedures, comparing the current year’s results to those of the previous year on an account-by-account basis. Explanations were obtained from management for all variances over $50,000 or 5% of the previous year’s balance.

14. The file includes a detailed review of all invoices paid to outside consultants, including several other accounting firms, and copies of their reports. One of the assignments relates to a “business review” of TVB carried out at the request of the bank.

The report for that assignment is not in the file.

Audit ReportThe audit report is issued by a certified public accountant who is appointed by the shareholders to provide assurance upon the truth and fairness of the financial statements prepared by the managers of the company. Audit report contains the... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Auditing An International Approach

ISBN: 978-1259087462

7th edition

Authors: Wally J. Smieliauskas, Kathryn Bewley