Following are statements of earnings and financial position for Wexler Industries. Required: a. Use professional judgment in

Question:

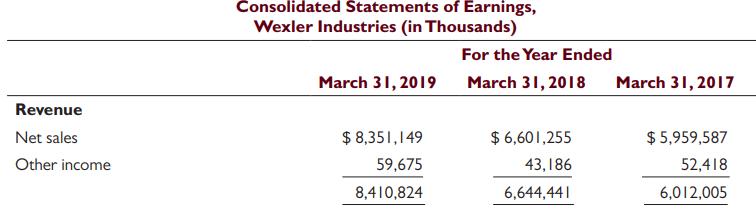

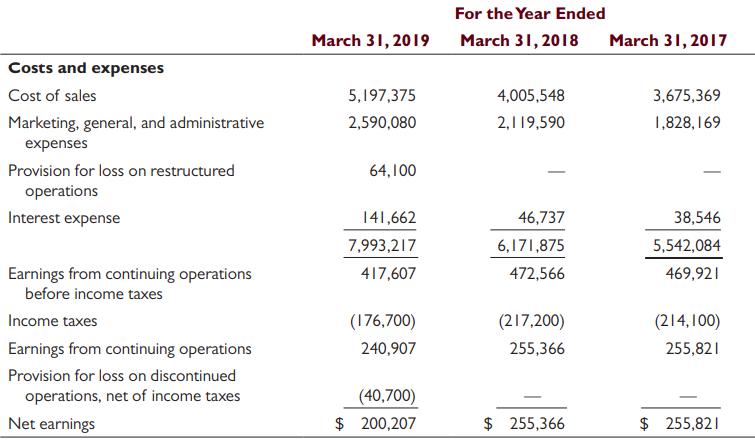

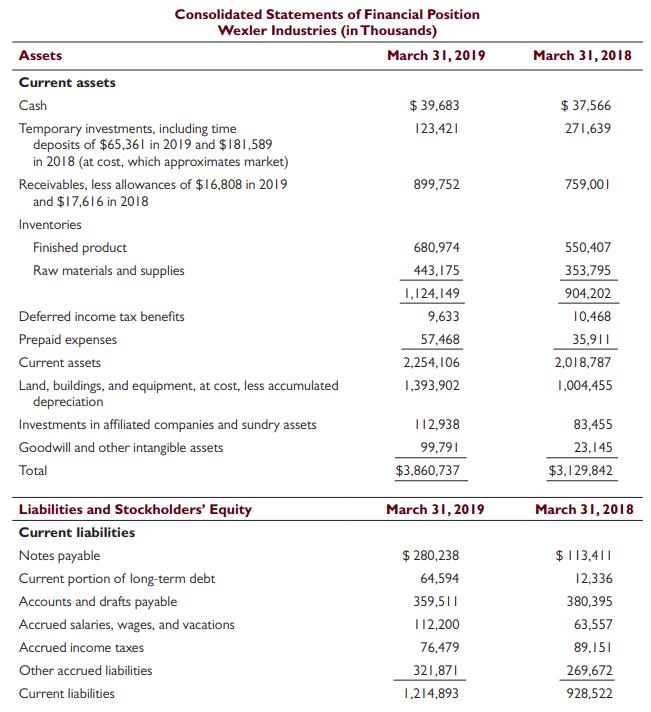

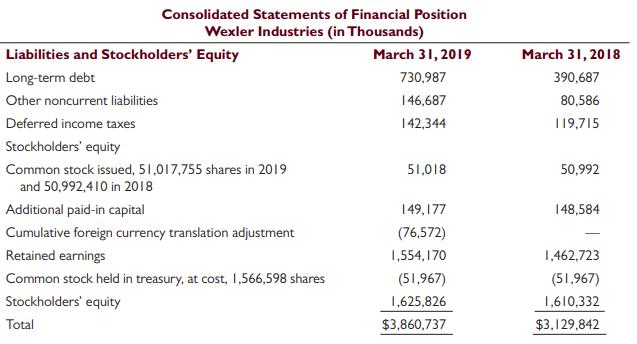

Following are statements of earnings and financial position for Wexler Industries.

Required:

a. Use professional judgment in deciding on the preliminary judgment about materiality for earnings, current assets, current liabilities, and total assets. Your conclusions should be stated in terms of percents and dollars.

b. Assume that you define materiality for the financial statements as a whole as a combined misstatement of earnings from continuing operations before income taxes of 5 percent. Also assume that you believe there is an equal likelihood of a misstatement of every account in the financial statements, and each misstatement is likely to result in an overstatement of earnings. Allocate materiality to these financial statements as you consider appropriate.

c. As discussed in part b., net earnings from continuing operations before income taxes was used as a base for calculating materiality for the Wexler Industries audit. Discuss why most auditors use before-tax net earnings instead of after-tax net earnings when calculating materiality based on the income statement.

d. Now assume that you have decided to allocate 75 percent of your preliminary judgment to accounts receivable, inventories, and accounts payable because you believe all other accounts have a low risk of material misstatement. How does this affect evidence accumulation on the audit?

e. Assume that you complete the audit and conclude that your preliminary judgment about materiality for current assets, current liabilities, and total assets has been met. The actual estimate of misstatements in earnings exceeds your preliminary judgment. What should you do?

Step by Step Answer:

Auditing And Assurance Services An Integrated Approach

ISBN: 9780135176146

17th Edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley