IndaCar Inc. (IC) operates a high-end car rental agency that specializes in the rental of unique vehicles

Question:

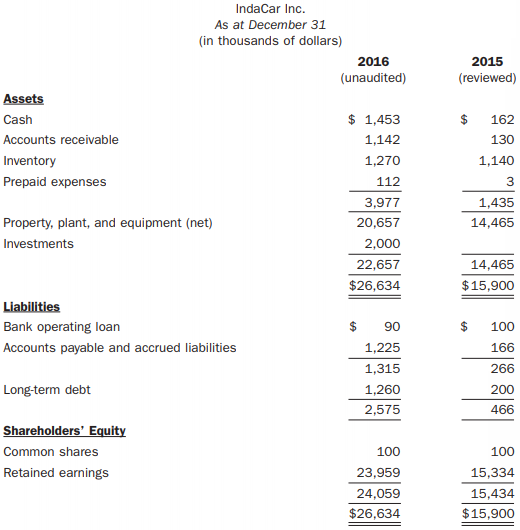

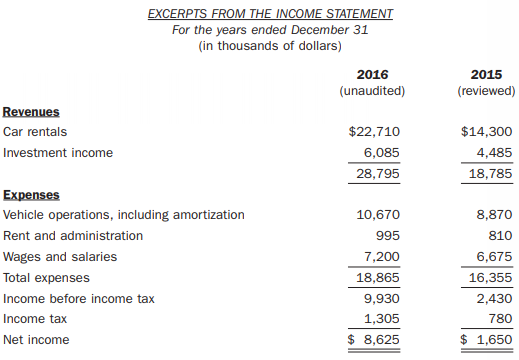

IndaCar Inc. (IC) operates a high-end car rental agency that specializes in the rental of unique vehicles and is located next to Lester B. Pearson International Airport in Toronto. IC is a private Canadian company that is wholly owned by Jake Bouvier. Daytona Lemans LLP, Chartered Professional Accountants (DL), has reviewed IC’s annual financial statements since IC was founded five years ago and has experienced no significant problems when performing the previous review engagements. You just found out you are the manager on the job for this year. As a result of IC’s success in Toronto, Jake is exploring the possibility of expanding IC’s operations to include the Vancouver and Calgary airports. Jake expects that he will be using IC’s fiscal 2016 financial statements to attract equity investors to partially finance this expansion. To maximize IC’s share value attractiveness to potential investors, Jake is wondering if he should have the fi nancial statements audited. Jake commented that he received a tip from one of the employees at the Pearson location that the manager is stealing cash. He wants to know if the regular audit engagement is likely to identify whether cash is being stolen and what procedures the auditor is likely to perform in this risk area. You have reviewed the fiscal 2015 engagement file in order to familiarize yourself with the client and to review the planning documentation prepared for the previous year’s engagement.

(a) Advise Jake on the costs and benefits of upgrading from a review engagement to an audit engagement.

(b) In planning the audit, the auditor must consider audit risk. Using the above case facts, make an inherent risk assessment.

(c) If the auditor decides that control risk is high, what type of audit will DL perform? How will this impact the amount of audit work?

(d) Calculate and conclude on the most appropriate planning materiality, and include a detailed explanation supporting your decision.

(e) For the following accounts, what assertions will the auditor be most concerned with? What evidence should the auditor gather to verify the management assertions?

1. Accounts receivable

2. Property, plant, and equipment

3. Accounts payable

4. Long-term debt

5. Car rental sales

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Auditing A Practical Approach

ISBN: 978-1118849415

2nd Canadian edition

Authors: Fiona Campbell, Robyn Moroney, Jane Hamilton, Valerie Warren