You are the in-charge accountant on the audit of Dezine Inc. (DI). It is March 25, 2020,

Question:

You are the in-charge accountant on the audit of Dezine Inc. (DI). It is March 25, 2020, and your firm is partway through the audit for the year ended January 31, 2020. You are currently assigned to work on various sections within the accounts payable and inventory section of the audit file. Inventory at year-end is $5.2 million. Materiality is set at $225 000.

COMPANY BACKGROUND

DI is a small manufacturer of women’s jewellery (including bracelets, necklaces, and earrings). Most of its products are made of silver, 14 Kt gold, and various semiprecious stones. DI has its financial statements audited due to a $15 million loan with RBC Business Financing Group. The terms of the loan require meeting certain financial covenants—a minimum inventory value of $5 million carried at “lower of cost and market” and a current ratio of 2:1. DI is also required to submit, within 90 days of its year-end, audited financial statements to RBC.

INFORMATION ON INVENTORY CYCLE

Most of the inventory consists of raw materials and finished goods. DI uses a periodic inventory system to track the physical quantity of goods on hand. The count is performed annually on January 31 of each year. Below are some details on the inventory and accounts payable cycle: Raw Materials Inventory

• DI uses the average costing method to price its raw materials (metals, stones, supplies, and packaging).

• The semiprecious stones and metals are purchased from suppliers in India and Mexico. Goods are shipped FOB shipping point (“free on board shipping point” means that ownership passes to the purchaser when goods leave the premises in India or Mexico).

• Goods take on average three weeks to arrive once the supplier has shipped them. The supplier notifies DI that the goods were shipped by emailing the freight and shipping documents.

• The party responsible (DI or the vendor) for insuring the goods during shipment is agreed to before shipment.

• All purchase orders are sent to the accounting department nonce issued.

• Shipping documents and freight/carrier invoices are emailed directly to the warehouse, after being reviewed (daily) by the purchasing manager and operations manager.

• All documents and freight/carrier invoices are sent to the accounting department.

• The accounting department matches the purchase orders and freight documents and then accrues the purchase. Work-in-Process and Finished Goods Inventory

• DI uses a job costing system. Costs are applied to the finished goods as they pass through casting, polishing, stone setting, and packaging.

• A manual job ticket is attached to each production batch with quantity of metals, stones, packaging, and number of labour hours (the value is applied at standard labour hour rates).

REQUIRED

a. Identify and explain the inherent risks that are present in the inventory cycle at DI. Tie each risk to the key assertion(s). Specifically tie your risks to case facts (not the inventory cycle in general). You can use the format of the table below to structure your answer.

![]()

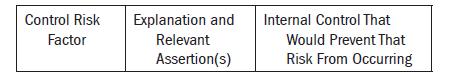

b. Identify and explain control risk factors that are present in the inventory cycle at DI that could impact existence, cutoff, and valuation of inventory at DI. For each control risk, provide an internal control that would prevent that risk from occurring. You can use the format of the table below to structure your answer.

Step by Step Answer:

Auditing The Art And Science Of Assurance Engagements

ISBN: 9780136692089

15th Canadian Edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Chris E. Hogan, Joanne C. Jones