Exercise 14.12 (Jump-Diffusion) Suppose that the underlying stock price follows the SDE (14.16) with being replaced

Question:

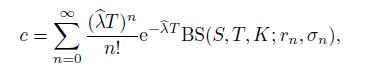

Exercise 14.12 (Jump-Diffusion) Suppose that the underlying stock price follows the SDE (14.16) with μ being replaced by the risk-free interest rate r under the risk-neutral probability measure Q. Assuming that the risk-neutral method is applicable,∗ show that the price of the call option with strike price K and maturity T written on the stock is given by

where S(0) = S, bλ = λ(1 + m),

with γ ≡ log(1 + m) = μy + σ2 y/2, and BS(S, T,K; r, σ) denotes the Black–

Scholes price function of the call option with volatility σ and instantaneous interest rate r.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Stochastic Processes With Applications To Finance

ISBN: 9781439884829

2nd Edition

Authors: Masaaki Kijima

Question Posted: