a. Suppose that at the inception of a five-year interest-rate swap in which the reference rate is

Question:

a. Suppose that at the inception of a five-year interest-rate swap in which the reference rate is three-month LIBOR, the present value of the floating-rate payments is $16,555,000. The fixedrate payments are assumed to be semiannual.

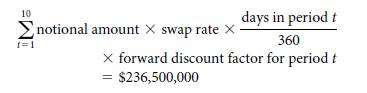

Assume also that the following is computed for the fixed-rate payments (using the notation in the chapter):

What is the swap rate for this swap?

b. Suppose that the five-year yield from the on-the-run Treasury yield curve is 6.4%. What is the swap spread?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: