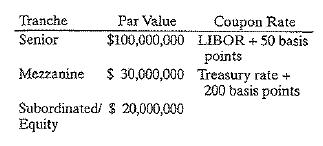

Consider the following basic $150 million CDO structure with the coupon rate to be offered at the

Question:

Consider the following basic $150 million CDO structure with the coupon rate to be offered at the time of issuance as shown:

Assume the following: The collateral consists of bonds that all mature in 10 years. The coupon rate for every bond is the 10-year Treasury rate plus 300 basis points. The collateral manager enters into an interest-rate swap agreement with another party with a notional amount of $100 million. . In the interest-rate swap the collateral manager agrees to pay a fixed rate each year equal to the 10-year Treasury rate plus 100 basis points and receive LIBOR.

a. Why is an interest-rate swap needed?

b. What is the potential return for the subordinate/equity tranche assuming no defaults?

c. Why will the actual return be less than the return computed?AppendixLO1

Step by Step Answer: