Following are U.S. Treasury benchmarks available on December 31, 2007: US/T 3.125 11/30/2009 3.133 US/T 3.375 11/30/2012

Question:

Following are U.S. Treasury benchmarks available on December 31, 2007:

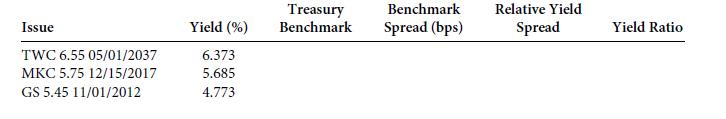

US/T 3.125 11/30/2009 3.133 US/T 3.375 11/30/2012 3.507 US/T 4.25 11/15/2017 4.096 US/T 4.75 02/15/2037 4.518 Based on the above, complete the following table:

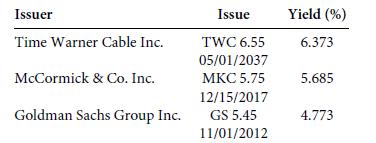

On the same day, the following trades were executed:

The yield spread between two corporate bond issues reflects more than just differences in their credit risk. What other factors would the yield spread reflect?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: