Question:

The supplemental prospectus of an actual offering by Royal Bank of Canada states the following:

b. What are the risks associated with investing in this structured note?

Transcribed Image Text:

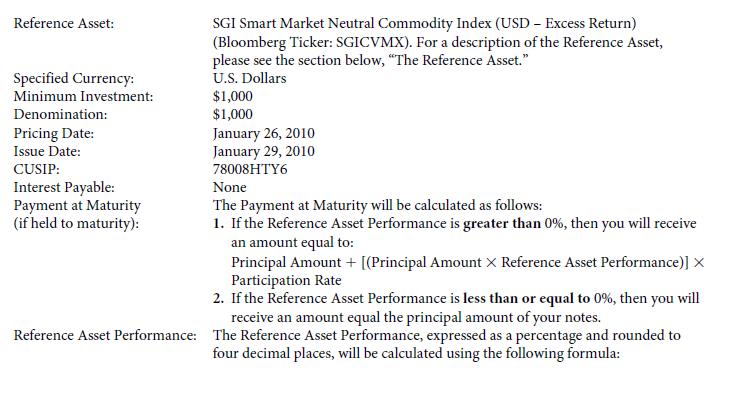

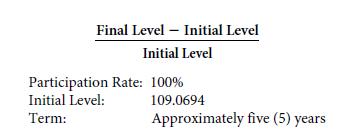

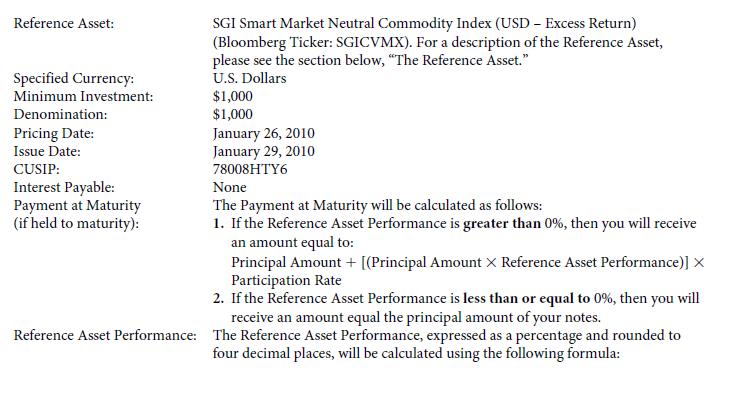

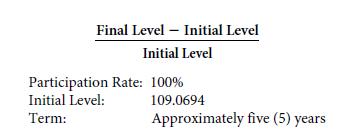

Reference Asset: Specified Currency: Minimum Investment: Denomination: Pricing Date: Issue Date: CUSIP: Interest Payable: Payment at Maturity (if held to maturity): SGI Smart Market Neutral Commodity Index (USD - Excess Return) (Bloomberg Ticker: SGICVMX). For a description of the Reference Asset, please see the section below, "The Reference Asset." U.S. Dollars $1,000 $1,000 January 26, 2010 January 29, 2010 78008HTY6 None The Payment at Maturity will be calculated as follows: 1. If the Reference Asset Performance is greater than 0%, then you will receive an amount equal to: Principal Amount + [(Principal Amount X Reference Asset Performance)] X Participation Rate 2. If the Reference Asset Performance is less than or equal to 0%, then you will receive an amount equal the principal amount of your notes. Reference Asset Performance: The Reference Asset Performance, expressed as a percentage and rounded to four decimal places, will be calculated using the following formula: