A Jack has the following purchases for the month of May 20X8: Required: (a) Enter up the

Question:

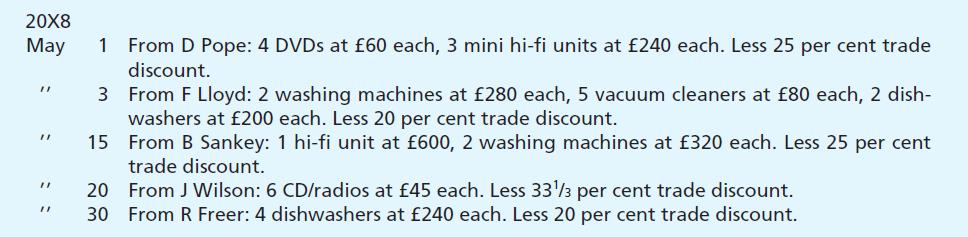

A Jack has the following purchases for the month of May 20X8:

Required:

(a) Enter up the purchases day book for the month.

(b) Post the transactions to the suppliers’ accounts.

(c) Transfer the total to the purchases account.

Transcribed Image Text:

20X8 May 1 From D Pope: 4 DVDs at £60 each, 3 mini hi-fi units at £240 each. Less 25 per cent trade discount. 3 From F Lloyd: 2 washing machines at £280 each, 5 vacuum cleaners at £80 each, 2 dish- washers at £200 each. Less 20 per cent trade discount. 15 From B Sankey: 1 hi-fi unit at £600, 2 washing machines at £320 each. Less 25 per cent trade discount. 20 From J Wilson: 6 CD/radios at £45 each. Less 33¹3 per cent trade discount. 30 From R Freer: 4 dishwashers at £240 each. Less 20 per cent trade discount. "1 "1 "1 11

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (6 reviews)

a Purchases Day Book for May 20X8 Date Supplier InvoiceDetails Amount Trade Discount Net Amount May ...View the full answer

Answered By

Sayee Sreenivas G B

I have extensive tutoring experience, having worked as a private tutor for over three years. I have tutored students from different academic levels, including high school, undergraduate, and graduate levels. My tutoring experience has taught me to be patient, attentive to student needs, and effective in communicating difficult concepts in simple terms.

I have a strong background in statistics, probability theory, data analysis, and data visualization. I am proficient in using statistical software such as R, Python, and SPSS, which are commonly used in academic research and data analysis. Additionally, I have excellent communication and interpersonal skills, which enable me to establish rapport with students, understand their learning styles, and adapt my teaching approach to meet their needs.

I am passionate about teaching and helping students achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Frank Woods Business Accounting Volume 1

ISBN: 9780273681496

10th Edition

Authors: Frank Wood, Alan Sangster

Question Posted:

Students also viewed these Business questions

-

J Glen has the following purchases for the month of June 20X9: Required: (a) Enter up the purchases day book for the month. (b) Post the items to the suppliers accounts. (c) Transfer the total to the...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Do you agree with the following statements? Why or why not? a. The benefits of corrective taxes as a way to reduce pollution have to be weighed against the deadweight losses that these taxes cause....

-

Charles Rubin is a 30-year employee of General Motors. Charles was pleased with recent negotiations between his employer and the United Auto Workers. Among other favorable provisions of the new...

-

Healthcare ethics committees: Address legal-ethical issues that arise during the course of a patients care and treatment. Serve as a hospital resource to patients, families, and staff, offering an...

-

5. Profits of $500,000 from the airport enterprise fund were transferred to the general fund of the city to subsidize general fund operations.

-

Suppose demand and supply are given by Qd = 60 - P and Qs = P - 20. a. What are the equilibrium quantity and price in this market? b. Determine the quantity demanded, the quantity supplied, and the...

-

moodle -UC Question 5 Not yet answered The adjusted trial balance of Banan Co at December 31, 2020 Follows Banan Co Trial Balance December 31, 2020 Accounts Title Debit Credit Marked out of 10.00...

-

C Phillips, a sole trader specialising in material for Asian clothing, has the following purchases and sales for March 20X9: Required: (a) Prepare the purchases and sales day books of C Phillips from...

-

J Fisher, White House, Bolton, is selling the following items at the retail prices as shown: plastic tubing at 1 per metre, polythene sheeting at 2 per length, vinyl padding at 5 per box, foam rubber...

-

Graph each function. (x) = 3 |x|

-

Q1. (a) Name the types of reactions that organic compounds undergo (b) Differentiate between (i) electrophile and nucleophile

-

CH4 Br, Ligtht Q2. (a) CH3Br + HBr Propose a mechanism for the reaction; indicating initiation, propagation and termination.

-

Q4. Complete the following reactions by drawing the structure(s) of the product(s) formed.

-

1. Why did the Iconoclast emperors believe that using images in worship was wrong? 2. How are recent examples of iconoclasm similar to those of the early medieval period? 3. Why is iconoclasm a...

-

1. Difference Between Essential and Non-Essential Nutrients 2. what is Conditionally Essential Nutrients? explain with examples

-

Sophie Vaillancourt started an investment management business, Vaillancourt Management on June 1, 2014. During the first month of operations, the business completed the following selected...

-

a. Determine the domain and range of the following functions.b. Graph each function using a graphing utility. Be sure to experiment with the window and orientation to give the best perspective of the...

-

A business buys a fixed asset for 10,000. The business estimates that the asset will be used for 5 years. After exactly 21/2 years, however, the asset is suddenly sold for 5,000. The business always...

-

A business buys a fixed asset for 10,000. The business estimates that the asset will be used for 5 years. After exactly 21/2 years, however, the asset is suddenly sold for 5,000. The business always...

-

Contractors Ltd was formed on 1 January 20X6 and the following purchases and sales of machinery were made during the first 3 years of operations. Each machine was estimated to last 10 years and to...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App