Adrian Frampton was considering the purchase of one of two businesses. However, Frampton had only been provided

Question:

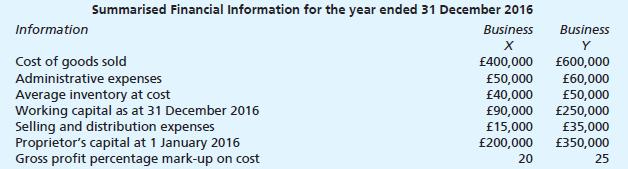

Adrian Frampton was considering the purchase of one of two businesses. However, Frampton had only been provided with limited information about the businesses, as follows:

Additional information:

1 Average inventory had been calculated by using the year’s opening and closing inventories. Subsequently it was discovered that Business Y had overvalued its inventory on 31 December 2016 by £10,000.

2 Business X’s administrative expenses included a payment for rent of £15,000 which covered a three year period to 31 December 2018.

3 A sum of £2,500 was included in the administrative expenses of Business Y in respect of a holiday taken by the owner and his family.

4 Cash drawings for the year ended 31 December 2016 were:

5 The owners of the businesses had stipulated the following prices for their businesses:

![]()

Required:

(a) Based on the information available prepare comparative statements of profit or loss for the year ending 31 December 2016.

(b) Using the information provided and the accounting statements prepared in (a), calculate relevant accounting ratios in order to give Frampton a basis for assessing the performances of the two businesses. Comment on the results.

(c) What additional information is needed in order to assess more accurately

(a) The liquidity of the businesses;

(b) The future prospects of the businesses?

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster