Cosnett Ltd is a company principally involved in the manufacture of aluminium accessories for camping enthusiasts. Its

Question:

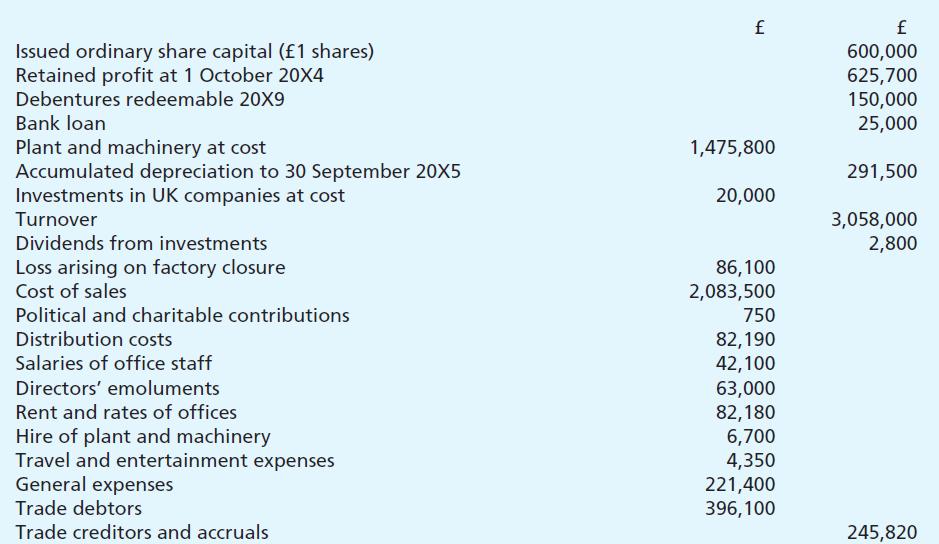

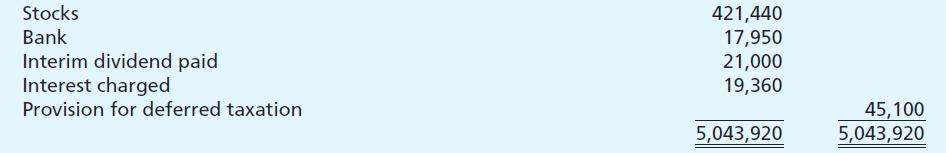

Cosnett Ltd is a company principally involved in the manufacture of aluminium accessories for camping enthusiasts. Its trial balance at 30 September 20X5 was:

You are provided with the following additional information:

(a) The company’s shares are owned, equally, by three brothers: John, Peter and Henry Phillips; they are also the directors.

(b) The bank loan is repayable by five annual instalments of £5,000 commencing 31 December 20X5.

(c) The investments were acquired with cash, surplus to existing operating requirements, which will be needed to pay for additional plant the directors plan to acquire early in 20X6.

(d) On 1 January 20X5 the company closed a factory which had previously contributed approximately 20 per cent of the company’s total production requirements.

(e) Trade debtors include £80,000 due from a customer who went into liquidation on 1 September 20X5; the directors estimate that a dividend of 20p in the £ will eventually be received.

(f) Trade creditors and accruals include:

(i) £50,000 due to a supplier of plant, of which £20,000 is payable on 1 January 20X6 and the remainder at the end of the year;

(ii) Accruals totalling £3,260.

(g) The mainstream corporation tax liability for the year is estimated at £120,000.

(h) The directors propose to pay a final dividend of 10.5p per share and to transfer £26,500 to the deferred tax account.

Required:

The profit and loss account of Cosnett Ltd for the year to 30 September 20X5 and balance sheet at that date together with relevant notes attached thereto. The accounts should comply with the minimum requirements of the Companies Acts and accounting standards so far as the information permits.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster