F Brown drew up the following trial balance as at 30 September 20X8. You are to draft

Question:

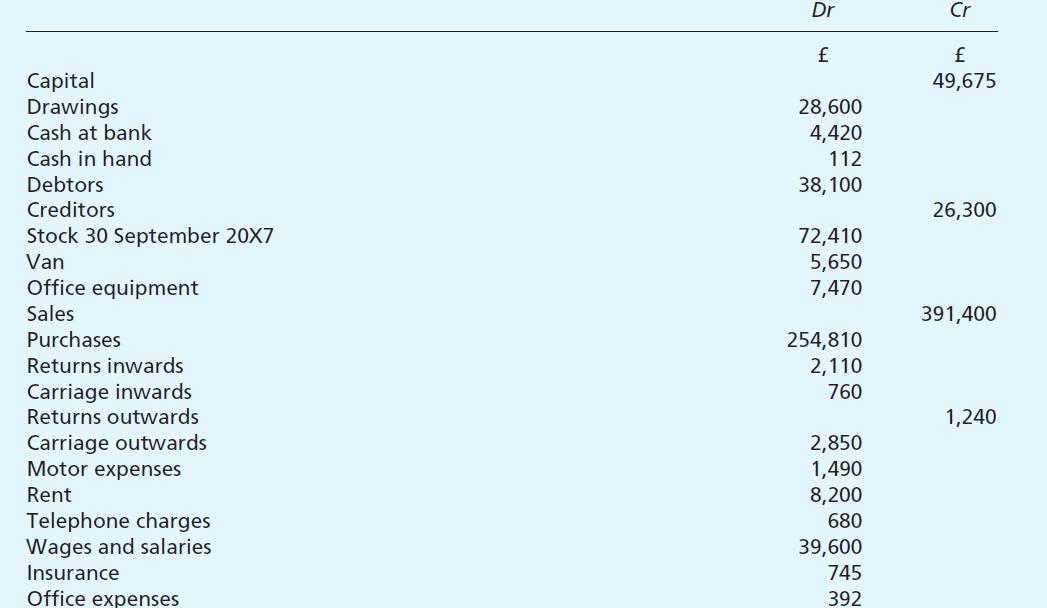

F Brown drew up the following trial balance as at 30 September 20X8. You are to draft the trading and profit and loss account for the year ended 30 September 20X8 and a balance sheet as at that date.

Stock at 30 September 20X8 was £89,404.

Transcribed Image Text:

Capital Drawings Cash at bank Cash in hand Debtors Creditors Stock 30 September 20X7 Van Office equipment Sales Purchases Returns inwards Carriage inwards Returns outwards Carriage outwards Motor expenses Rent Telephone charges Wages and salaries Insurance Office expenses Dr لیا 28,600 4,420 112 38,100 72,410 5,650 7,470 254,810 2,110 760 2,850 1,490 8,200 680 39,600 745 392 Cr £ 49,675 26,300 391,400 1,240

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

Trading and Profit and Loss Account for the Year Ended 30 September 20X8 Particulars Amount Particul...View the full answer

Answered By

Faith Chebet

In the past two years many of my students have excell with the knowledge I taught them.

0.00

0 Reviews

10+ Question Solved

Related Book For

Frank Woods Business Accounting Volume 1

ISBN: 9780273681496

10th Edition

Authors: Frank Wood, Alan Sangster

Question Posted:

Students also viewed these Business questions

-

Wellness Medical System Inc. (Wellness) is a privately held company specializing in medical software for mental healthcare professionals in Canada. The company has been operating from its...

-

B. Good drew up the following trial balance as at 31 March 20X3. Extract the statement of profit and loss for the year ended 31 March 20X3 and statement of financial position as at that date....

-

B. Good drew up the following trial balance as at 31 March 20X3. Closing information included the following: 1. Inventories at the yearend were valued at £35,650. 2. An accrual for wages of...

-

Strike Bowling installs automatic scorekeeping equipment with an invoice cost of $180,000. The electrical work required for the installation costs $8,000. Additional costs are $3,000 for delivery and...

-

To focus on the core issues, we ignored the income tax effects of the pension amounts we recorded in the chapter. Reproduced below are the journal entries from the chapter that Global Communications...

-

Structured awards are those placed in a trust set up to provide compensation over a plaintiffs lifetime.

-

Use Figure 183 to select the advertising media you will include in your plan by analyzing how combinations of media (e.g., television and Internet advertising, radio and yellow pages advertising) can...

-

Assume all of the companys sales are on account. The accounts receivable balance at the beginning of the year was $512, and the ending balance was $481. During the year, the company had sales of...

-

Consider the information below about the following three stocks: Amethyst, Sapphire and Tanzanite. Amethyst Sapphire Tanzanite Market Price $26 $16 $10 Number of Shares 4 20 3 Cash $10 $65 $22 Debt...

-

From the following trial balance of Kingfire, extracted after one year of operations, prepare a trading and profit and loss account for the year ending 30 June 20X3, together with a balance sheet as...

-

The following is the trial balance of T Owen as at 31 March 20X9. Draw up a set of financial statements for the year ended 31 March 20X9. Stock at 31 March 20X9 was 58,440. Stock 1 April 20X8 Sales...

-

Indicate which of the following accounts are current assets and which are long-term assets: Prepaid Rent, Building, Furniture, Accounts Receivable, Merchandise Inventory, Cash, Note Receivable (due...

-

The employee.class.php file contains an abstract, base class named Employee . One of the attributes of the class is an object of Person . This demonstrates one of the three relationship types among...

-

A direct shear test is performed on a saturated specimen of loose sand. A normal stress equal to 100 kPa is applied and a maximum shear stress of 75 kPa is measured in the shear test. Determine the...

-

How does budgeting help managers? Budgeting helps managers determine if their goals are ethical and achievable. Budgeting helps managers determine if their goals are reasonable and achievable....

-

If the 230-lb block is released from rest when the spring is unstretched, determine the velocity of the block after it has descended 5ft . The drum has a weight of 70lb and a radius of gyration of...

-

A B C D E F 1 Frequency : Monthly 2 Loan Amount: 150000.00 3 Interest Rate: 7.25% 4 Term(years): 30.00 5 No. of payments in a year: 12 time(s) 6 Periodic Rate: 0.60% =C3/C5 7 Total number of payment:...

-

Refer to the Summary Problem for Your Review, specifically the trial balance on page 91. Required 1. Write the company's accounting equation, and label each element as a debit amount or a credit...

-

The following exercises are not grouped by type. Solve each equation. x610x -9

-

Three companies have the capital structures shown below. The return on capital employed was 20% for each firm in 2016, and in 2017 was 10%. Corporation tax in both years was assumed to be 55%, and...

-

Huge plc acquired a holding of 600,000 of the 800,000 ordinary 1 shares of Large plc on 1 October 2015 when the revenue reserves of Large stood at 320,000. On 1 October 2016, the directors of Medium...

-

Huge plc acquired a holding of 600,000 of the 800,000 ordinary 1 shares of Large plc on 1 October 2015 when the revenue reserves of Large stood at 320,000. On 1 October 2016, the directors of Medium...

-

TestAnswerSavedHelp opens in a new windowSave & ExitSubmit Item 1 7 1 0 points Time Remaining 1 hour 2 0 minutes 1 8 seconds 0 1 : 2 0 : 1 8 Item 1 7 Time Remaining 1 hour 2 0 minutes 1 8 seconds 0 1...

-

Use the following information for the Problems below. (Algo) [The following information applies to the questions displayed below.] Lansing Company's current-year income statement and selected balance...

-

In the context of portfolio theory, what is diversification primarily intended to do ? A ) Increase returns. B ) Reduce risk. C ) Maximize tax efficiency. D ) Simplify investment management.

Study smarter with the SolutionInn App