In the previous example we concluded that at an interest rate of 15%, a positive NPV of

Question:

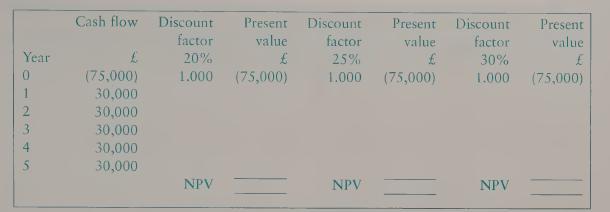

In the previous example we concluded that at an interest rate of 15%, a positive NPV of £25,560 made Keith’s investment worthwhile. In other words, Keith would be getting a return on the project in excess of 15%. Using the following pro forma and the present value factors in the Appendix, calculate the net present value for the project using interest rates of 20%, 25% and 30%.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Business Accounting An Introduction To Financial And Management Accounting

ISBN: 9780230276239

2nd Edition

Authors: Jill Collis, Roger Hussey, Andrew Holt, Holt Collis, J. Collis

Question Posted: