Jarvis Jackets Ltd makes leather jackets. It has two cost centres: the cutting department where the jackets

Question:

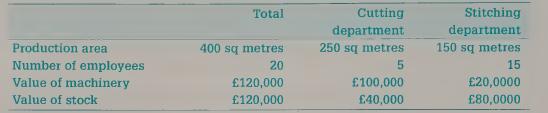

Jarvis Jackets Ltd makes leather jackets. It has two cost centres: the cutting department where the jackets are cut out by machine, and the stitching department where they are sewn and finished. Some of the production overheads have been allocated to the two cost centres from information available within the business, but the remainder must be apportioned in some way. The following information should help you decide a fair way of sharing them between the two departments.

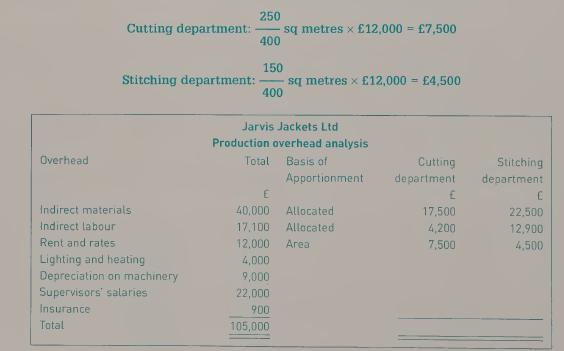

Before you can complete the following pro forma, you need to decide on the basis on which the production overheads will be apportioned and then calculate the portion that will be borne by each cost centre. The indirect materials and indirect labour used in production have already been allocated and entered in the analysis. The rent has also been apportioned to show you the method. Rent is best apportioned on the basis of the area occupied. The total area is 250 + 150 = 400 sq metres and the rent is £12,000. Therefore, the rent can be apportioned as follows:

Step by Step Answer:

Business Accounting An Introduction To Financial And Management Accounting

ISBN: 9780230276239

2nd Edition

Authors: Jill Collis, Roger Hussey, Andrew Holt, Holt Collis, J. Collis