Keith Hackett is considering whether to buy computer-aided design equipment that will improve his cash flows by

Question:

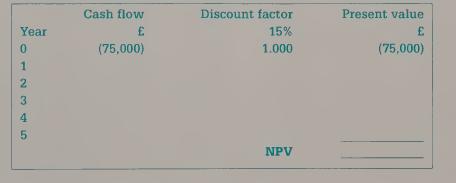

Keith Hackett is considering whether to buy computer-aided design equipment that will improve his cash flows by £30,000 per annum for the next 5 years. At the end of this time, the equipment will have reached the end of its useful economic life as it will be out of date and have no residual value. The equipment will cost £75,000 and will be bought for cash. The interest rate that Keith thinks is suitable is 15%. Calculate the NPV of this investment project using the following pro forma and the present value factors in the Appendix.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Business Accounting An Introduction To Financial And Management Accounting

ISBN: 9780230276239

2nd Edition

Authors: Jill Collis, Roger Hussey, Andrew Holt, Holt Collis, J. Collis

Question Posted: