Large plc, a manufacturer and wholesaler, purchased 600,000 of the 800,000 issued ordinary shares of a smaller

Question:

Large plc, a manufacturer and wholesaler, purchased 600,000 of the 800,000 issued ordinary shares of a smaller company, Small Ltd, on 1 January 19X5 when the retained earnings account of Small Ltd had a credit balance of £72,000.

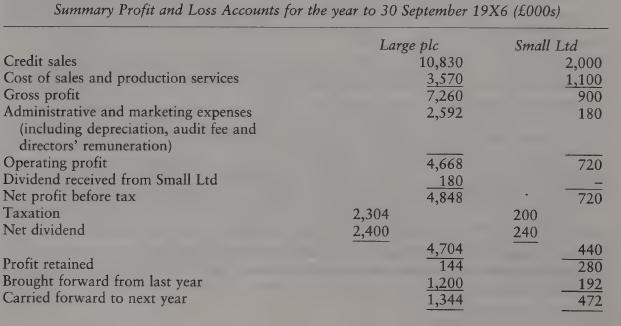

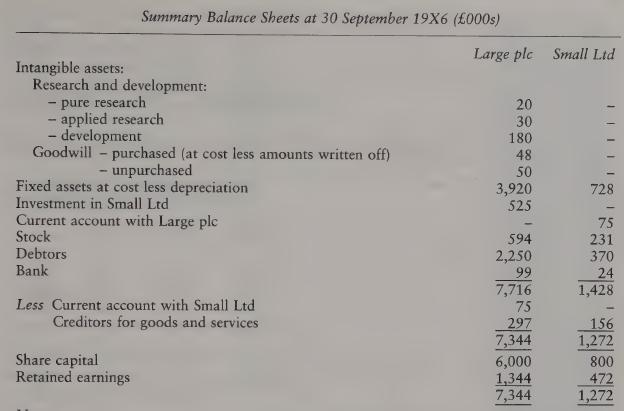

The latest accounts of the two companies are:

The intangible asset section of the balance sheet of Large plc has not yet been amended prior to consolidation to take account of the provisions of the Companies Acts or the recommendations contained in accounting standards regarding intangible assets.

The stock of Large plc contained goods valued at £108,000 purchased from Small Ltd at production cost plus 50 per cent.

Required:

(a) Prepare the consolidated profit and loss account of Large plc and its subsidiary Small Ltd for the year to 30 September 19X6 using the acquisition (purchase) method of consolidation.

(b) Prepare the consolidated balance sheet of Large plc and its subsidiary Small Ltd at 30 September 19X6 using the acquisition method of consolidation.

(c) What would the reserves of the group be if the merger method of consolidation were used instead of the acquisition method? Briefly explain why there is a difference between the values of the reserves arising from the two methods of consolidation.

Step by Step Answer: