Long Acre Ltd has just finished its first year of trading to 31 December 19X3. Corporation tax

Question:

Long Acre Ltd has just finished its first year of trading to 31 December 19X3.

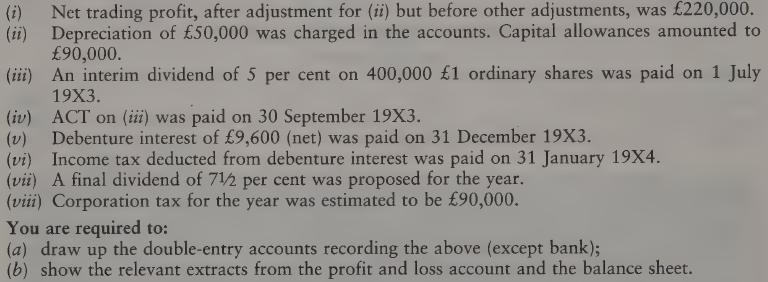

Corporation tax throughout was 35 per cent, the ACT rate was 20 per cent and income tax 25 per cent. You are given the following information:

Transcribed Image Text:

(i) Net trading profit, after adjustment for (ii) but before other adjustments, was 220,000. (ii) Depreciation of 50,000 was charged in the accounts. Capital allowances amounted to 90,000. (iii) An interim dividend of 5 per cent on 400,000 1 ordinary shares was paid on 1 July 19X3. (iv) ACT on (iii) was paid on 30 September 19X3. (v) Debenture interest of 9,600 (net) was paid on 31 December 19X3. (vi) Income tax deducted from debenture interest was paid on 31 January 19X4. (vii) A final dividend of 71/2 per cent was proposed for the year. (viii) Corporation tax for the year was estimated to be 90,000. You are required to: (a) draw up the double-entry accounts recording the above (except bank); (b) show the relevant extracts from the profit and loss account and the balance sheet.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

ANDREW KIPRUTO

Academic Writing Expert

I have over 7 years of research and application experience. I am trained and licensed to provide expertise in IT information, computer sciences related topics and other units like chemistry, Business, law, biology, biochemistry, and genetics. I'm a network and IT admin with +8 years of experience in all kind of environments.

I can help you in the following areas:

Networking

- Ethernet, Wireless Airmax and 802.11, fiber networks on GPON/GEPON and WDM

- Protocols and IP Services: VLANs, LACP, ACLs, VPNs, OSPF, BGP, RADIUS, PPPoE, DNS, Proxies, SNMP

- Vendors: MikroTik, Ubiquiti, Cisco, Juniper, HP, Dell, DrayTek, SMC, Zyxel, Furukawa Electric, and many more

- Monitoring Systems: PRTG, Zabbix, Whatsup Gold, TheDude, RRDtoo

Always available for new projects! Contact me for any inquiries

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Long Acre Ltd has just finished its first year of trading to 31 December 19X3. Corporation tax throughout was 35 per cent and income tax 25 per cent. You are given the following information: (i) Net...

-

Camden Lock Ltd has just finished its first year of trading to 31 December 20X6. Corporation tax throughout was 40 per cent and income tax 20 per cent. You are given the following information: (i)...

-

Camden Lock Ltd has just finished its first year of trading to 31 December 2006. Corporation tax throughout was 40 per cent and income tax 20 per cent. You are given the following information: (i)...

-

Heating oil futures contracts are traded on the New York Mercantile Exchange (NYM), a division of the CME Group. The standard contract size for heating oil futures is 43,600 gallons per contract. You...

-

Write the important resonance structures for each of the following: (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) CH2 CH-Br NO2

-

Gerrard Construction Co. is an excavation contractor. The following summarized data (in thousands) are taken from the December 31, 2022, financial statements: At December 31, 2021, total assets were...

-

As part of a project targeted at improving the services of a local bakery, a management consultant (L. Lei of Rutgers University) monitored customer arrivals for several Saturdays and Sundays. Using...

-

In the audit of Potomac Mills, the auditors wish to test the costs assigned to manufactured goods. During the year, the company has produced 2,000 production lots with a total recorded cost of $5.9...

-

Question No. 11 VOG Itd. issued $500,000 of 8-year, 9% bonds at 102 on January 1, 2018. The bonds pay interest annually. Assume that company uses straight line method for amortization. Prepare the...

-

The following salaried employees of Mountain Stone Brewery in Fort Collins, Colorado, are paid semimonthly. Some employees have union dues or garnishments deducted from their pay. Calculate their net...

-

Long Acre Ltd has just finished its second year of trading to 31 December 19X4. Balances per 11.1 need to be brought forward into this question. Tax rates are the same as for 19X3. The following...

-

Checkers Ltd was incorporated on 1 April 19X5 and took over the business of Black and White, partners, as from 1 January 19XS5. It was agreed that all profits made from 1 January should belong to the...

-

A boat is traveling along a circular curve having a radius of 100 ft. If its speed at t = 0 is 15 ft/s and is increasing at v = (0.8t) ft/s, determine the magnitude of its acceleration at the instant...

-

While sovling y' = Ky(Ay), we used the fact that 1 y(1) 1 1 - y y-A Use partial fraction decomposition (and a bit of algebra) to show that this is true. 1) Use partial fractions. Do not merely...

-

You are fluent in three languages. In terms of your strengths, this is an example of what? a. Personal brand b. Vocation c. Experience d. Competency

-

Miller Company's contribution format income statement for the most recent month is shown below: Sales (45,000 units) Variable expenses Contribution margin Fixed expenses Net operating income...

-

Find f''(x). f(x) = (x+8) 5 f''(x) =

-

How does the market play into business financials? 2- How do stocks and bonds play into the future of the organization? 3- What is the future value of money and what is it used for? 4- What is a...

-

Refer to the data in Exercise E3- 38B. Patel Foundrys accountant found an error in the expense records from the year reported. Depreciation on manufacturing plant and equipment was actually $...

-

It is possible to investigate the thermo chemical properties of hydrocarbons with molecular modeling methods. (a) Use electronic structure software to predict cHo values for the alkanes methane...

-

Assume that an investment of $100,000 is expected to grow during the next year by 8% with SD 20%, and that the return is normally distributed. Whats the 5% VaR for the investment? A. $24,898 B....

-

Simpson Ltd is a small IT company, which has 2 million shares outstanding and a share price of $20 per share. The management of Simpson plans to increase debt and suggests it will generate $3 million...

-

The following are the information of Chun Equipment Company for Year 2 . ( Hint: Some of the items will not appear on either statement, and ending retained earnings must be calculated. ) Salaries...

An Engineers Introduction To Programming With MATLAB 2019 1st Edition - ISBN: 1630572926 - Free Book

Study smarter with the SolutionInn App