Oldfield Enterprises Limited was formed on 1 January 19X5 to manufacture and sell a new type of

Question:

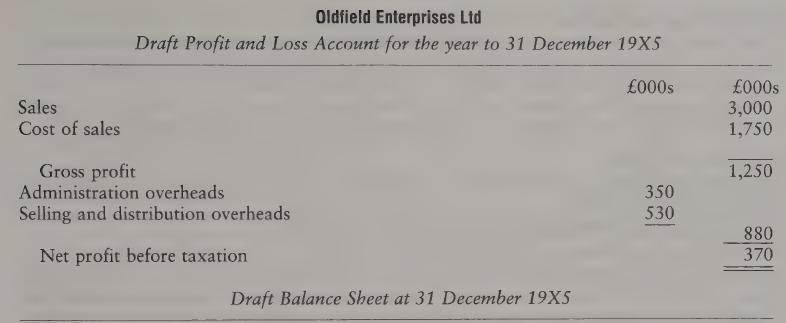

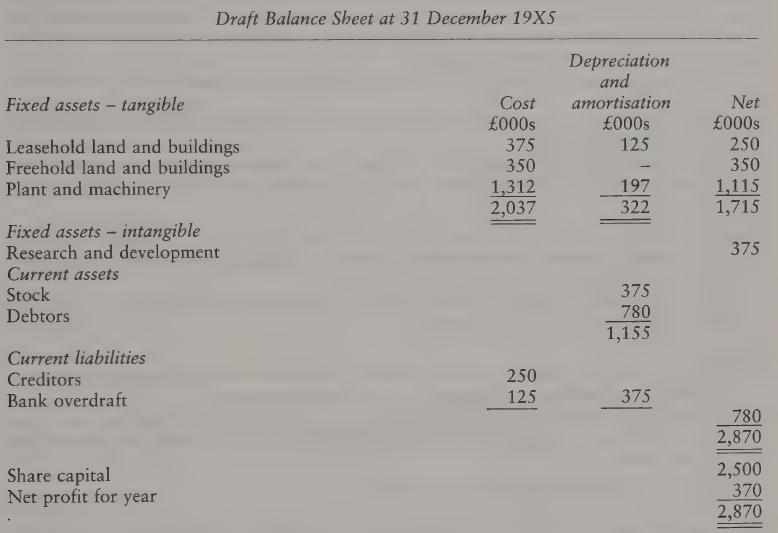

Oldfield Enterprises Limited was formed on 1 January 19X5 to manufacture and sell a new type of lawn mower. The bookkeeping staff of the company have produced monthly figures for the first ten months to 31 October 19X5 and from these figures together with estimates for the remaining two months, Barry Lamb, the managing director, has drawn up a forecast profit and loss account for the year to 31 December 19X5 and a balance sheet as at that date.

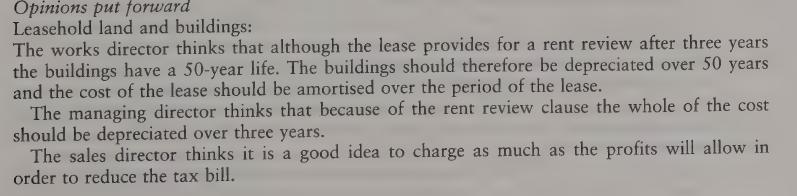

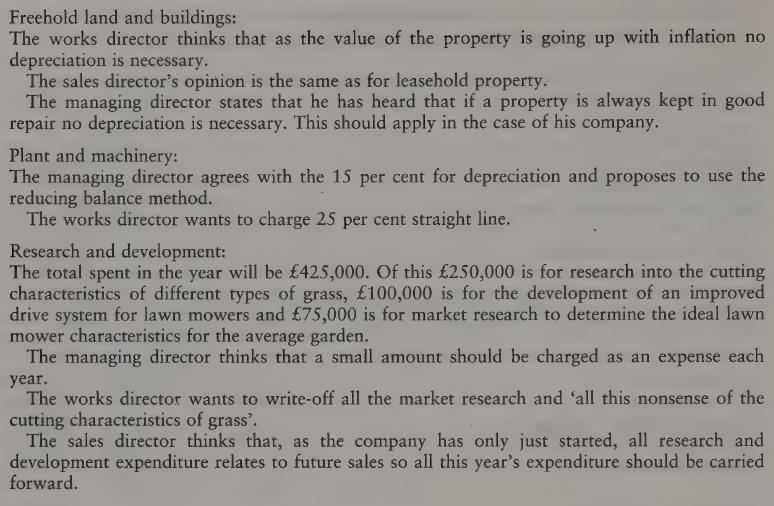

These statements together with the notes are submitted to the board for comment. During the board meeting discussion centres on the treatment given to the various assets. The various opinions are summarised by Barry Lamb who brings them, with the draft accounts, to you as the company’s financial adviser.

(a) Administration overheads include £50,000 written-off research and development.

(b) The lease is for 15 years and cost £75,000. Buildings have been put up on the leasehold land at a cost of £300,000. Plant and machinery has been depreciated at 15 per cent.

Both depreciation and amortisation are included in cost of sales.

Required:

(a) You are asked to comment on each opinion stating what factors should be taken into account to determine suitable depreciation and write off amounts.

(b) Indicate what amounts should, in your opinion, be charged to profit and loss and show the adjusted profit produced by your recommendations, stating clearly any assumptions you may make.

Step by Step Answer: