On 1 January 2001 a business purchased a laser printer for 1,800. The printer has an estimated

Question:

On 1 January 2001 a business purchased a laser printer for £1,800. The printer has an estimated life of 4 years after which it will have no residual value.

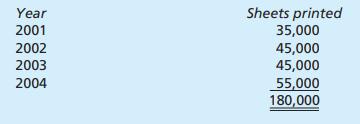

It is expected that the output from the printer will be:

Required:

(a) Calculate the annual depreciation charges for 2001, 2002, 2003 and 2004 on the laser printer on the following bases:

(i) the straight line basis, (ii) the diminishing balance method at 60% per annum, and (iii) the units of output method.

Note: Your workings should be to the nearest £.

(b) Suppose that in 2004 the laser printer were to be sold on 1 July for £200 and that the business had chosen to depreciate it at 60% per annum using the diminishing balance method applied on a month for month basis.

Reconstruct the following accounts for 2004 only:

(i) the laser printer account, (ii) the provision for depreciation – laser printer account, and (iii) the assets disposals account.

Step by Step Answer:

Business Accounting Uk Gaap Volume 1

ISBN: 9780273718765

1st Edition

Authors: Frank Wood, Alan Sangster