On 30 September 19X7, B Wright, who prepares final accounts annually to 30 September, bought a motor

Question:

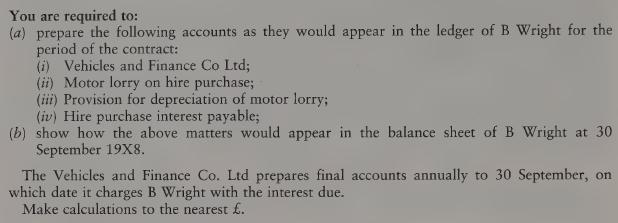

On 30 September 19X7, B Wright, who prepares final accounts annually to 30 September, bought a motor lorry on hire purchase from the Vehicles and Finance Co. Ltd.

The cash price of the lorry was £3,081. Under the terms of the hire purchase agreement, Wright paid a deposit of £1,000 on 30 September 19X7, and two instalments of £1,199 on 30 September, 19X8 and 19X9. The hire vendor charged interest at 10 per cent per annum on the balance outstanding on 1 October each year. All payments were made on the due dates. Wright maintained the motor lorry account at cost and accumulated the annual provision for depreciation, at 25 per cent on the diminishing balance method, in a separate account.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: