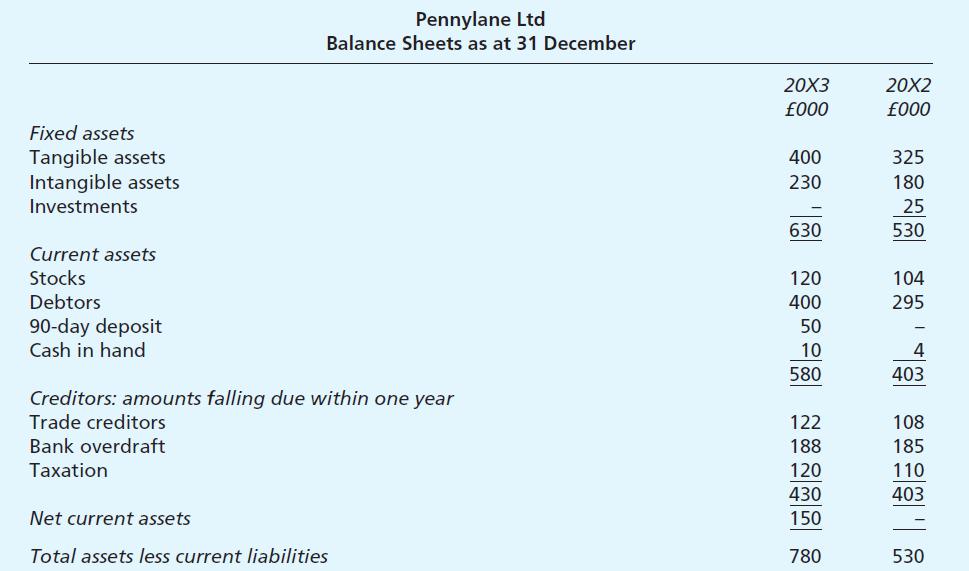

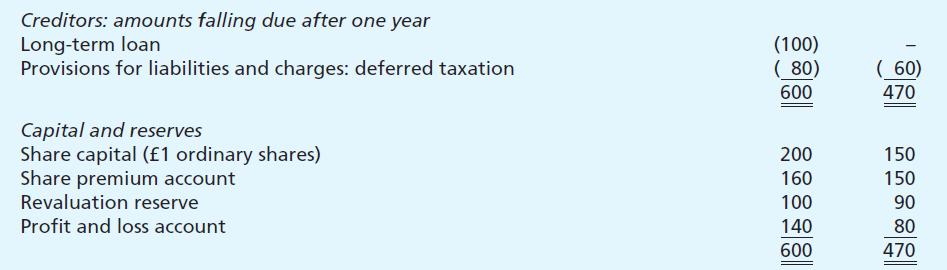

The balance sheets and additional information relating to Pennylane Ltd are given below. Prepare a cash flow

Question:

The balance sheets and additional information relating to Pennylane Ltd are given below.

Prepare a cash flow statement for Pennylane Ltd for the year ended 31 December 20X3 as required under FRS 1 using the indirect method, together with Note 1 to the statement. (Do not attempt to provide the reconciliation of net cash flow to net debt.)

Additional information:

(a) During the year interest of £75,000 was paid, and interest of £25,000 was received.

(b) The following information relates to tangible fixed assets.

(c) The proceeds of the sale of fixed asset investments were £30,000.

(d) Plant, with an original cost of £90,000 and a net book value of £50,000, was sold for £37,000.

(e) Tax paid to the Inland Revenue during 20X3 amounted to £110,000.

(f) Dividends of £80,000 were paid during 20X3.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster