The chief accountant of Uncertain Ltd is not sure of the appropriate accounting treatment for a number

Question:

The chief accountant of Uncertain Ltd is not sure of the appropriate accounting treatment for a number of events occurring during the year 2016/17.

(i) A significant number of employees have been made redundant, giving rise to redundancy payments of £100,000 which have been included in manufacturing cost of sales.

(ii) One of Uncertain Ltd’s three factories has been closed down. Closure costs amounted to £575,000. This amount has been deducted from reserves in the statement of financial position.

(iii) The directors have changed the basis of charging depreciation on delivery vehicles. The difference between the old and new methods amounts to £258,800. This has been treated as a charge in accounting policy and the comparative figures have been adjusted accordingly.

(iv) During October 2016 a fire occurred in one of the remaining factories belonging to Uncertain Ltd and caused an estimated £350,000 of additional expenses. This amount has been included in manufacturing cost of sales.

(v) It was discovered on 31 October 2017 that a customer was unable to pay his debt to the company of £125,000. The £125,000 was made up of sales in the period July to September 2017. No adjustment has been made in the draft accounts for this item.

Required:

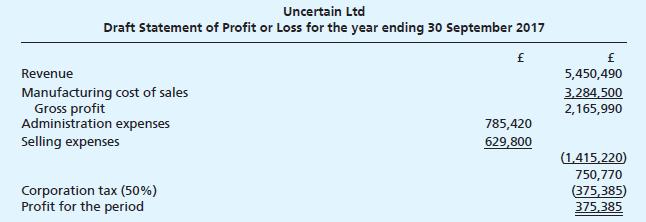

(a) Write a report to the chief accountant of Uncertain Ltd with suggestions for appropriate treatment for each of the items (i) to (v), with explanations for your proposals.

(b) Amend the draft statement of profit or loss to take account of your proposals.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster