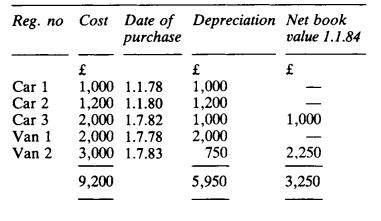

The following is a summary of a company's motor vehicle register, as at 1 January 1984: Depreciation

Question:

The following is a summary of a company's motor vehicle register, as at 1 January 1984:

Depreciation has always been provided at 25 per cent p.a., straight line basis. A full year's depreciation has been provided in the year of purchase, and no depreciation is provided in the year of disposal.

During the year 1984 the following transactions took place:

(i) Car 1 was destroyed in a crash. £100 was received from the insurance company.

(ii) Car 4 and Car 5, which are identical, were bought from a garage which took Car 2 in part exchange, at a valuation of £200. Only one cheque (for £4,800) passed through the company's books relating to this transaction.

(iii) Van 1 was sold for £200 on 31 December 1984.

(iv) Van 3 was bought on 30 September 1984 for £4,000.

(v) Van 2 is an articulated unit, comprising a cab and a separate trailer. The trailer proved too small and on 30 June 1984 the existing trailer (only) was traded in for a larger trailer. The company paid an extra £1,000 cash, and was allowed £500 on the old trailer, this being half of its original cost.

Required:

(a) (1) Prepare a similar summary of the motor vehicle register as at 1 January 1985; (2) state the profit or loss on motor vehicle disposals for the year; (3) state the depreciation charge for the year; (4)

what would be the effect on the company's net profit if the company decided to provide a full year's depreciation in the year of disposing of motor vehicles?

(b) As regards the total net book value figure, which appears in the balance sheet: (1) what does it represent?; (2) how useful is it;

how could it be made more useful?

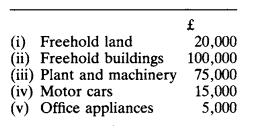

The A.B.C. Co. Ltd showed the following cost values in its books at the year ended 31 December 1984:

The rates of depreciation, as used by the company, are (ii) 2 % fixed instalment.

(iii) 15% reducing balance.

(iv) 25 % reducing balance.

(v) 25 % reducing balance.

Required:

(a) Show the ledger accounts for each asset as at 31 Decembe r 1984 assuming that the whole of the assets were purchased on 1 January 1982 and that depreciation has been taken for each year.

(b) Show the entries required to record'the following transactions, all of which took place after three years' depreciation had been charged: (1) an item of plant which cost £500 was scrapped with no residual value; (2) a motor car which cost £800 was sold for £350.

Step by Step Answer: