The following list of balances as at 31 July 20X6 has been extracted from the books of

Question:

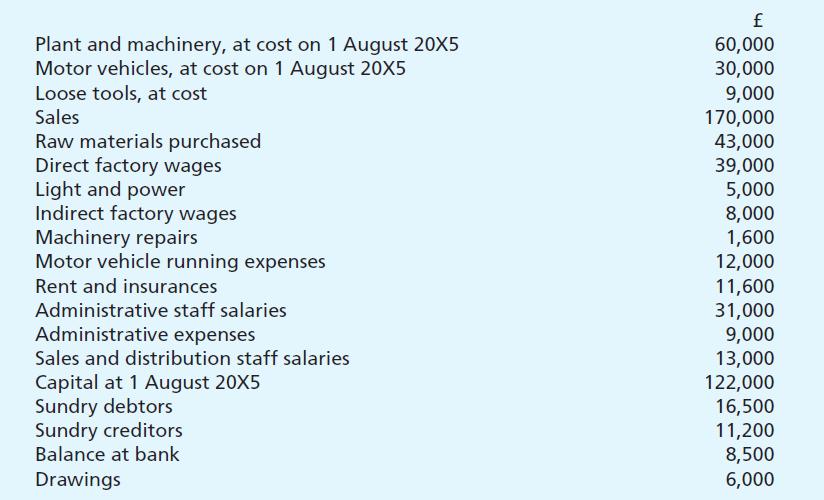

The following list of balances as at 31 July 20X6 has been extracted from the books of Jane Seymour who commenced business on 1 August 20X5 as a designer and manufacturer of kitchen furniture:

Additional information for the year ended 31 July 20X6:

(i) It is estimated that the plant and machinery will be used in the business for 10 years and the motor vehicles used for 4 years: in both cases it is estimated that the residual value will be nil. The straight line method of providing for depreciation is to be used.

(ii) Light and power charges accrued due at 31 July 20X6 amounted to £1,000 and insurances prepaid at 31 July 20X6 totalled £800.

(iii) Stocks were valued at cost at 31 July 20X6 as follows:

(iv) The valuation of work in progress at 31 July 20X6 included variable and fixed factory overheads and amounted to £12,300.

(v) Two-thirds of the light and power and rent and insurances costs are to be allocated to the factory costs and one-third to general administration costs.

(vi) Motor vehicle costs are to be allocated equally to factory costs and general administration costs.

(vii) Goods manufactured during the year are to be transferred to the trading account at £95,000.

(viii) Loose tools in hand on 31 July 20X6 were valued at £5,000.

Required:

(a) Prepare a manufacturing, trading and profit and loss account for the year ended 31 July 20X6 of Jane Seymour.

(b) An explanation of how each of the following accounting concepts have affected the preparation of the above accounts:

- Conservatism,

- Matching,

- Going concern.

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9780273681496

10th Edition

Authors: Frank Wood, Alan Sangster