The following table shows the cumulative effects of a succession of separate transactions on the assets and

Question:

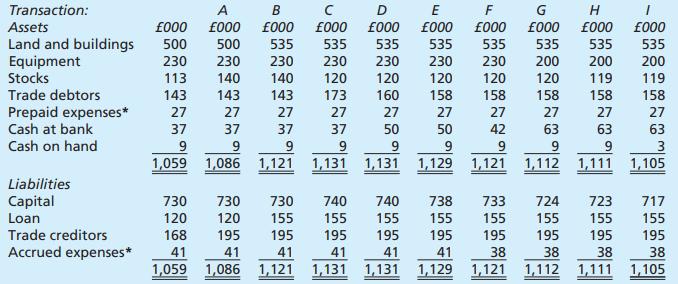

The following table shows the cumulative effects of a succession of separate transactions on the assets and liabilities of a business. The first column of data gives the opening position.

Required:

Identify clearly and as fully as you can what transaction has taken place in each case. Give two possible explanations for transaction I. Do not copy out the table but use the reference letter for each transaction.

Association of Accounting Technicians Authors’ Note: You have not yet been told about ‘prepaid expenses’ and ‘accrued expenses’.

Prepaid expenses are expenses that have been paid in advance, the benefits of which will only be felt by the business in a later accounting period. Because the benefit of having incurred the expense will not be received until a future time period, the expense is not included in the calculation of profit for the period in which it was paid. As it was not treated as an expense of the period when profit was calculated, the debit in the account is treated as an asset when the balance sheet is prepared, hence the appearance of the term ‘prepaid expenses’ among the assets in the question. Accrued expenses, on the other hand, are expenses that have not yet been paid for benefits which have been received. In F, £8,000 was paid out of the bank account of which £3,000 was used to pay off some of the accrued expenses.

Step by Step Answer:

Business Accounting Uk Gaap Volume 1

ISBN: 9780273718765

1st Edition

Authors: Frank Wood, Alan Sangster