The information given below has been extracted from the accounting records of Cedarwood Ltd for the year

Question:

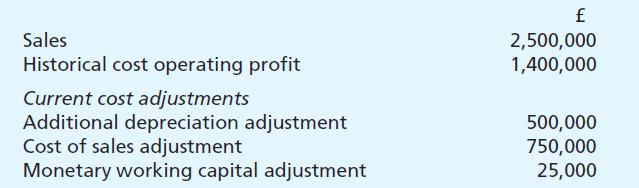

The information given below has been extracted from the accounting records of Cedarwood Ltd for the year ended 30 June 20X4. Prepare a statement showing the current cost operating profit to 30 June 20X4.

Transcribed Image Text:

Sales Historical cost operating profit Current cost adjustments Additional depreciation adjustment Cost of sales adjustment Monetary working capital adjustment £ 2,500,000 1,400,000 500,000 750,000 25,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 77% (9 reviews)

To calculate the current cost operating profit for Cedarwood Ltd for the year ended 30 June 20X4 you...View the full answer

Answered By

User l_998468

I have extensive tutoring experience, having worked as a private tutor for over three years. I have tutored students from different academic levels, including high school, undergraduate, and graduate levels. My tutoring experience has taught me to be patient, attentive to student needs, and effective in communicating difficult concepts in simple terms.

I have a strong background in statistics, probability theory, data analysis, and data visualization. I am proficient in using statistical software such as R, Python, and SPSS, which are commonly used in academic research and data analysis. Additionally, I have excellent communication and interpersonal skills, which enable me to establish rapport with students, understand their learning styles, and adapt my teaching approach to meet their needs.

I am passionate about teaching and helping students achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster

Question Posted:

Students also viewed these Business questions

-

The information given below has been extracted from the accounting records of Beechgrove Ltd for the year ending 30 June 2017. Prepare a statement showing the current cost operating profit to 30 June...

-

The directors of Chekani plc, a large listed company, are engaged in a policy of expansion. Accordingly, they have approached the directors of Meela Ltd, an unlisted company of substantial size, in...

-

(a) The following are the costing records for the year 2017 of a manufacturer: Production 20,000 units; Cost of Raw Materials 2,00,000; Labour Cost 1,20,000; Factory Overheads 80,000; Office...

-

Tony acquired 1,000 shares in X Co (a resident public company) for $10 each in August 2000. In January this year X Co returned $7 of capital to its shareholder in respect to each share they held. The...

-

Why would the Fed seldom do an open market purchase of government securities at the same time that it raises the discount rate or the required reserve ratio?

-

Special Order Pricing You are the controller for Tippets Watch Company, a manufacturer of high-quality watches. The company has excess watches, which it has not been able to market through its own...

-

17-11. What are apps and why are they important?

-

A rower wants to row her kayak across a channel that is 1400 ft wide and land at a point 800 ft upstream from her starting point. She can row (in still water) at 7 ft/s and the current in the channel...

-

19.25 (LO 3) (NOL Carryforward, Valuation Account Needed) Meyer reported the bonus pretax financial income (loss) for the years 2020-2022 2020 $120,000 2021 (150,000) 2022 180,000 Pretax financial...

-

An experiment was conducted regarding a quantitative analysis of factors found in high-density lipoprotein (HDL) in a sample of human blood serum. Three variables thought to be predictive of, or...

-

The balance sheet for Cremore Ltd at 31 December 20X3 is given below (000): Required: Using the above information, calculate the gearing adjustment percentage: Plant and machinery Cost Depreciation...

-

If the relevant price indices for trade debtors and trade creditors are as follows, calculate the monetary working capital adjustment for Seafield Ltd, using the details given in question 30.9A. Data...

-

Ifan adjusting entry for accrued expenses is not made, which of the following items will be overstated? (a) Expenses (b) Assets (c) Profit (d) Liabilities (e) All of the above

-

Determine dy/dr when 3x+4y = 3.

-

Problem 3. Doping a Semiconductor The following chemical scheme is used to introduce P-atoms as a dopant into a semiconductor - a silicon chip. POCI3 Cl POCI 3 vapor P P SiO2 + P(s) CVD coating Si...

-

The system shown in the following figure is in static equilibrium and the angle is equal to 34 degrees. Given that the mass1 is 8 kg and the coefficient of static friction between mass1 and the...

-

Pre-Writing step for a report for your boss on Richard Hackman's statement that using a team to complete a complex project may not be the best approach. Review your classmates' contributions to the...

-

For the graph of the equation x = y - 9, answer the following questions: the x- intercepts are x = Note: If there is more than one answer enter them separated by commas. the y-intercepts are y= Note:...

-

Refer to Problems 29 and 30. If in fact last year's values lost to purse snatching are normally distributed, which is the preferred procedure for performing the hypothesis test-the t-test or the...

-

The following items were displayed in the statement of affairs for Lubbock Company: Fully secured liabilities ......... $90,000 Partially secured liabilities ....... 12,000 Unsecured liabilities...

-

OTL Ltd commenced business on 1 January 2017. The head office is in London and there is a branch in Highland. The currency of Highland is the crown. The following are the trial balances of the head...

-

What benefits accrue to the investor in a parent undertaking by the use of consolidated financial statements?

-

What determines whether or not one company is a subsidiary undertaking of another company?

-

When credit terms for a sale are 2/15, n/40, the customer saves by paying early. What percent (rounded) would this savings amount to on an annual basis

-

An industrial robot that is depreciated by the MACRS method has B = $60,000 and a 5-year depreciable life. If the depreciation charge in year 3 is $8,640, the salvage value that was used in the...

-

What determines a firm's beta? Should firm management make changes to its beta? Be sure to consider the implications for the firm's investors using CAPM.

Study smarter with the SolutionInn App