Find the value A of a principal P = $100 set out at an interest rate r

Question:

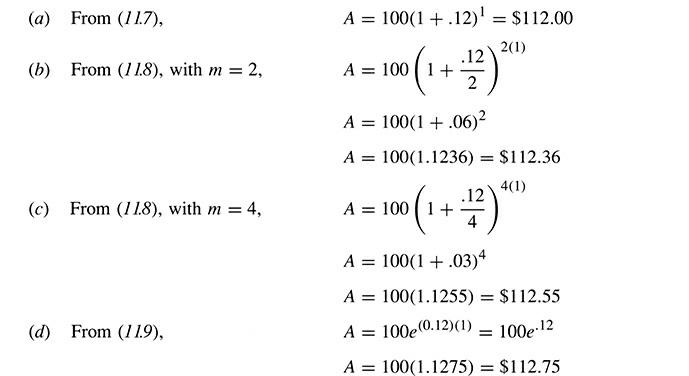

Find the value A of a principal P = $100 set out at an interest rate r = 12 percent for time t = 1 year when compounded

(a) annually,

(b) semiannually,

(c) quarterly, and

(d) continuously; (e)

distinguish between the nominal and the effective rate of interest. Use a calculator for exponential expressions, as explained in Section 1.7.11 and Problems 1.23 to 1.26.

(e) In all four instances the stated or nominal interest rate is the same, namely, 12 percent; the actual interest earned, however, varies according to the type of compounding. The effective interest rate on multiple compoundings is the comparable rate the bank would have to pay if interest were paid only once a year, specifically, 12.36 percent to equal semiannual compounding, 12.55 percent to equal quarterly compounding, and 12.75 percent to equal continuous compounding.

Step by Step Answer:

Schaum S Outline Of Mathematical Methods For Business Economics And Finance

ISBN: 978-1264266876

2nd Edition

Authors: Luis Moises Pena Levano