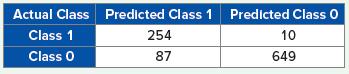

Compute the misclassification rate, accuracy rate, sensitivity, precision, and specificity for the following confusion matrix. Actual Class

Question:

Compute the misclassification rate, accuracy rate, sensitivity, precision, and specificity for the following confusion matrix.

Transcribed Image Text:

Actual Class Predicted Class 1 Predicted Class 0 Class 1 Class 0 254 87 10 649

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 28% (7 reviews)

FP FN 8710 97 Misclassification rate TP TN FP FN 25464...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Business Analytics Communicating With Numbers

ISBN: 9781260785005

1st Edition

Authors: Sanjiv Jaggia, Alison Kelly, Kevin Lertwachara, Leida Chen

Question Posted:

Students also viewed these Business questions

-

Compute the misclassification rate, accuracy rate, sensitivity, precision, and specificity for the following confusion matrix. Actual Class Class 1 Class 0 Predicted Class 1 Predicted Class 0 25...

-

Compute the misclassification rate, accuracy rate, sensitivity, precision, and specificity for the following confusion matrix. Actual Class Class 1 Class 0 Predicted Class 1 Predicted Class 0 378...

-

Compute the misclassification rate, accuracy rate, sensitivity, precision, and specificity for the following confusion matrix. Actual Class Class 1 Class 0 Predicted Class 1 Predicted Class 0 67 278...

-

A decision maker is working on a problem that requires her to study the uncertainty surrounding the payoff of an investment. There are three possible levels of payoff $1,000, $5,000, and $10,000. As...

-

A compact speaker puts out 100 W of sound power. (a) Neglecting losses to the air, at what distance would the sound intensity be at the pain threshold? (b) Neglecting losses to the air, at what...

-

Mike Lynch manages a real estate firm in Myrtle Beach, South Carolina, and would like to construct a model to help him predict the selling price of beach properties for his customers based on the age...

-

What must we get? LO,1

-

1. How did Jim conclude that the process was not capable based on his first set of samples? 2. Does the second set of samples show anything that the first set didnt? Explain what and why. 3. Assuming...

-

A stock has no dividends. Last periods FCFE is $5.38 and it has an estimated annual free cash flow growth rate of 7.8%. The required return for this stock is 12.85% and its long term growth rate is...

-

Osprey Corporation, an accrual basis taxpayer, reported taxable income for 2021 and paid $40,000 on its estimated state income tax for the year. During 2021, the company received a $4,000 refund upon...

-

Answer the following questions using the accompanying data set that lists the actual class memberships and predicted Class 1 (target class) probabilities for 10 observations. a. Compute the...

-

Construct a confusion matrix using the accompanying data set that lists actual and predicted class memberships for 10 observations.

-

In the Oregon health care plan for rationing Medicaid expenditures, therapy to slow the progression of AIDS and treatment for brain cancer were covered, while liver transplants and treatment for...

-

Idenfity whether the following book - tax adjustments are permanent or temporary differences. ( a ) Federal Income Tax Expense ( b ) Depreciation Expense ( c ) Accrued Compensation ( d ) Dividends...

-

2 . ) Pozycki, LLC has reported losses of $ 1 0 0 , 0 0 0 per year since its founding in 2 0 1 6 . For 2 0 2 3 , Pozycki anticipates a profit of about $ 1 0 0 , 0 0 0 . There are 3 equal members of...

-

Elena is a single taxpayer for tax year 2023. On April 1st, 2022, Elena's husband Nathan died. On July 13, 2023, Elena sold the residence that Elena and Nathan had each owed and used as their...

-

Rodriguez Corporation issues 12,000 shares of its common stock for $56,600 cash on February 20. Prepare journal entries to record this event under each of the following separate situations. 1. The...

-

Problem 3: A large rectangular plate is loaded in such a way as to generate the unperturbed (i.e. far-field) stress field xx = Cy; yy = -C x; Oxy = 0 The plate contains a small traction-free circular...

-

Write the expression relating gage pressure, absolute pressure, and atmospheric pressure.

-

a. What is the cost of borrowing if Amarjit borrows $28 500 and repays it over a four-year period? b. How many shares of each stock would he get if he used the $28 500 and invested equally in all...

-

Four years ago, Susan loaned $7,000 to her friend Joe. During the current year, the $7,000 loan is considered worthless. Explain how Susan should treat the worthless debt for tax purposes.

-

Why did the Supreme Court rule in Arkansas Best that the stock of a corporation purchased by the taxpayer to protect the taxpayers business reputation was a capital asset?

-

The effective tax rate on gain of $1 million resulting from the sale of qualified small business stock obtained in 2005 in an initial public offering and held more than five years is 14%. Do you...

-

crane Inc. common chairs currently sell for $30 each. The firms management believes that it's share should really sell for $54 each. If the firm just paid an annual dividend of two dollars per share...

-

Determine the simple interest earned on $10,000 after 10 years if the APR is 15%

-

give me an example of 10 transactions from daily routine that we buy and put for me Liabilities + Owners' Equity + Revenues - Expenses

Study smarter with the SolutionInn App