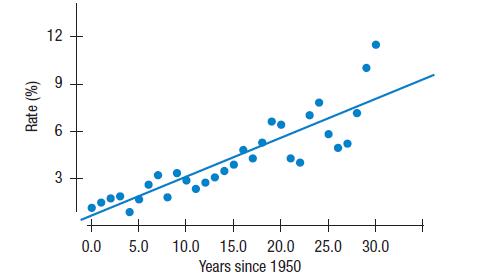

Historical interest rates. Heres a plot showing the federal rate on 3-month Treasury bills from 1950 to

Question:

Historical interest rates. Here’s a plot showing the federal rate on 3-month Treasury bills from 1950 to 1980, and a regression model fit to the relationship between the Rate

(in %) and Years since 1950. (www.gpoaccess.gov/eop/)

Dependent variable is: Rate R-squared = 77.4% s = 1.239 Variable Coeff Intercept 0.640282 Year-1950 0.247637

a) What is the correlation between Rate and Year?

b) Interpret the slope and intercept.

c) What does this model predict for the interest rate in the year 2000?

d) Would you expect this prediction to have been accurate?

Explain.

Step by Step Answer:

Related Book For

Business Statistics

ISBN: 9781292269313

4th Global Edition

Authors: Norean Sharpe, Richard De Veaux, Paul Velleman

Question Posted: