a. A small group of investors is considering planting a tree farm. Their choices are (1) dont

Question:

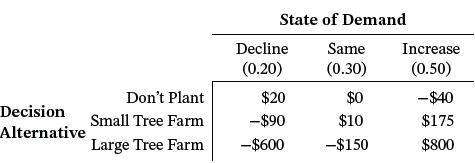

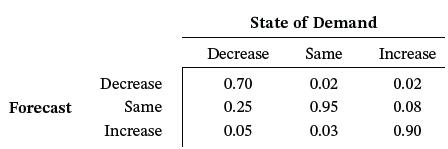

a. A small group of investors is considering planting a tree farm. Their choices are (1) don’t plant trees, (2) plant a small number of trees, or (3) plant a large number of trees. The investors are concerned about the demand for trees. If demand for trees declines, planting a large tree farm would probably result in a loss. However, if a large increase in the demand for trees occurs, not planting a tree farm could mean a large loss in revenue opportunity. They determine that three states of demand are possible: (1) demand declines, (2) demand remains the same as it is, and (3) demand increases. Use the following decision table to compute an EMV for this decision opportunity. b. Industry experts who believe they can forecast what will happen in the tree industry contact the investors. The following matrix shows the probabilities with which it is believed these experts can foretell tree demand. Use these probabilities to revise the prior probabilities of the states of nature and recompute the expected value of sample information. How much is this sample information worth?

b. Industry experts who believe they can forecast what will happen in the tree industry contact the investors. The following matrix shows the probabilities with which it is believed these experts can foretell tree demand. Use these probabilities to revise the prior probabilities of the states of nature and recompute the expected value of sample information. How much is this sample information worth?

Step by Step Answer:

Business Statistics For Contemporary Decision Making

ISBN: 9781119577621

3rd Canadian Edition

Authors: Ken Black, Ignacio Castillo