An investor is comparing two stocks, A and B. She wants to know if over the long

Question:

An investor is comparing two stocks, A and B.

She wants to know if over the long run, there is a significant difference in the return on investment as measured by the percent increase or decrease in the price of the stock from its date of purchase. The investor takes a random sample of 50 annualized daily returns over the past five years for each stock.

The data are summarized below.

Stock Mean return Standard deviation A 11.8% 12.9%

B 7.1% 9.6%

(a) Is there a significant difference in the mean return on investment for the two stocks? Support your answer with appropriate statistical evidence. Use a 5%

significance level.

(b) The investor believes that although the return on investment for Stock A usually exceeds that of Stock B, Stock A represents a riskier investment, where the risk is measured by the price volatility of the stock. The standard deviation is a statistical measure of the price volatility and indicates how much an investment’s actual performance during a specified period varies from its average performance over a longer period. Do the price fluctuations in Stock A significantly exceed those of Stock B, as measured by their standard deviations? Identify an appropriate set of hypotheses that the investor is interested in testing.

(c) To measure this, we will construct a test statistic defined as F =

large sample variance smaller sample variance What value(s) of the statistic would indicate that the price fluctuations in Stock A significantly exceed those of Stock B? Explain.

(d) Calculate the value of the F statistic using the information given in the table.

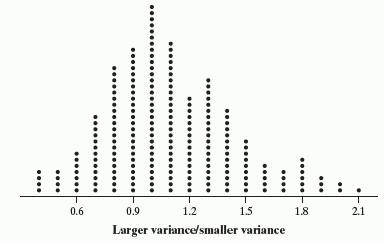

(e) Two hundred simulated values of this test statistic, F, were calculated assuming no difference in the standard deviations of the returns for the two stocks.

The results of the simulation are displayed in the following dotplot.

Use these simulated values and the test statistic that you calculated in part

(d) to determine whether the observed data provide convincing evidence that Stock A is a riskier investment than Stock B. Explain your reasoning.

Step by Step Answer: