Question: A stock analyst wants to determine whether there is a difference in the mean return on equity for three types of stock: utility, retail, and

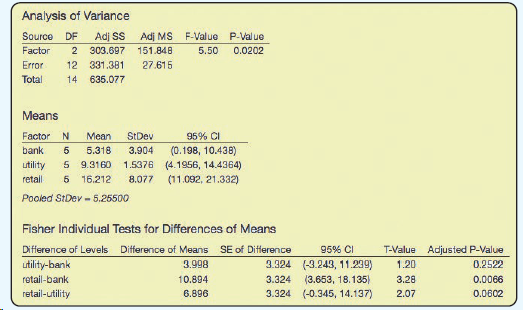

A stock analyst wants to determine whether there is a difference in the mean return on equity for three types of stock: utility, retail, and banking stocks. The following output is obtained:

a. Using the .05 level of significance, is there a difference in the mean return on equity among the three types of stock?

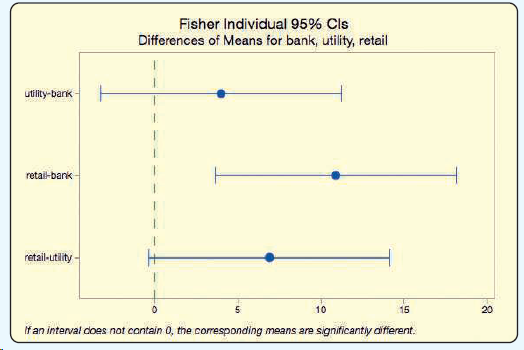

b. Can the analyst conclude there is a difference between the mean return on equity for utility and retail stocks? For utility and banking stocks? For banking and retail stocks? Explain.

Analysis of Variance Source DF Adj S 303.697 Adj MS F-Value P-Value Factor 151.848 5.50 0.0202 12 331.381 27.615 Error Total 635.077 14 Means Factor N. Mean StDev 95% CI bank 5.318 3.904 (0.198, 10.438) (4.1956, 14.4364) (11.092, 21.332) 5 9.3160 5 16.212 uitility 1.5376 retail 8.077 Pooled StDev - 5,25500 Fisher Individual Tests for Differences of Means Difference of Levels Difference of Means SE of Difference 95% CI T-Value Adjusted P-Value 3.324 (3.243, 11.239) utility-bank 3.998 1.20 0.2522 retail-bank 3.324 (3.653, 18.135) 0.0066 10.894 3.28 3.324 (-0.345, 14.137) retail-utility 6.896 2.07 0.0602 Fisher Individual 95% Cls Differences of Means for bank, utility, retail utility-bark retail-bark retail-utlity - 10 15 20 If an interval does not contain 0, the corresponding means are significantly different.

Step by Step Solution

3.46 Rating (169 Votes )

There are 3 Steps involved in it

a The hypothesis is H o m 1 m 2 m H 1 At least one mean differ... View full answer

Get step-by-step solutions from verified subject matter experts