Uzmas trial balance drawn up at the end of her financial year did not balance, but she

Question:

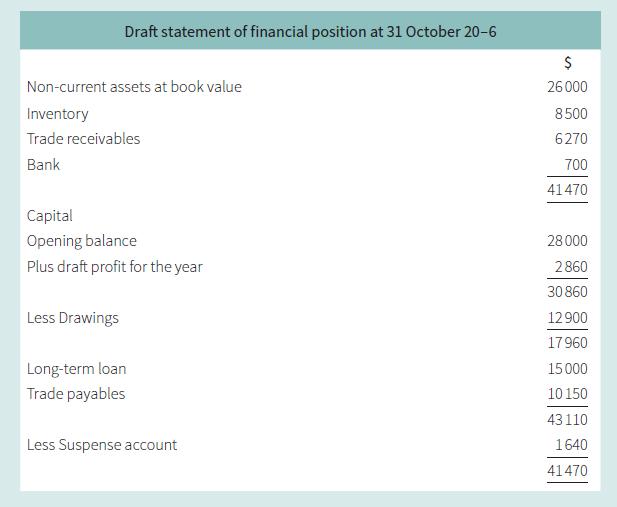

Uzma’s trial balance drawn up at the end of her financial year did not balance, but she proceeded to prepare draft financial statements. The statement of financial position she prepared is provided.

The following errors were later discovered:

1. No adjustment had been made for prepaid rent at 31 October 20–6 of $480.

2. The balance of the petty cash book, $120, had been omitted from the trial balance.

3. $200 paid to a credit supplier by bank transfer had been recorded in the cash book but not in the supplier’s account.

4. Purchases on credit, $990, have not been entered in the accounting records.

5. The sales journal was overcast by $1,000.

6. The total of the discount allowed account, $320, had been omitted from the trial balance (and consequently omitted from the income statement).

a. Write up the suspense account. Close or balance the account as necessary.

b. Calculate the correct profit for the year.

c. Prepare a corrected statement of financial position at 31 October 20–6.

Step by Step Answer:

Cambridge IGCSE And O Level Accounting Coursebook

ISBN: 9781316502778

2nd Edition

Authors: Catherine Coucom